E-mini Dow Futures - a Weak Pullback

rhboskres

Publish date: Wed, 03 Apr 2019, 04:58 PM

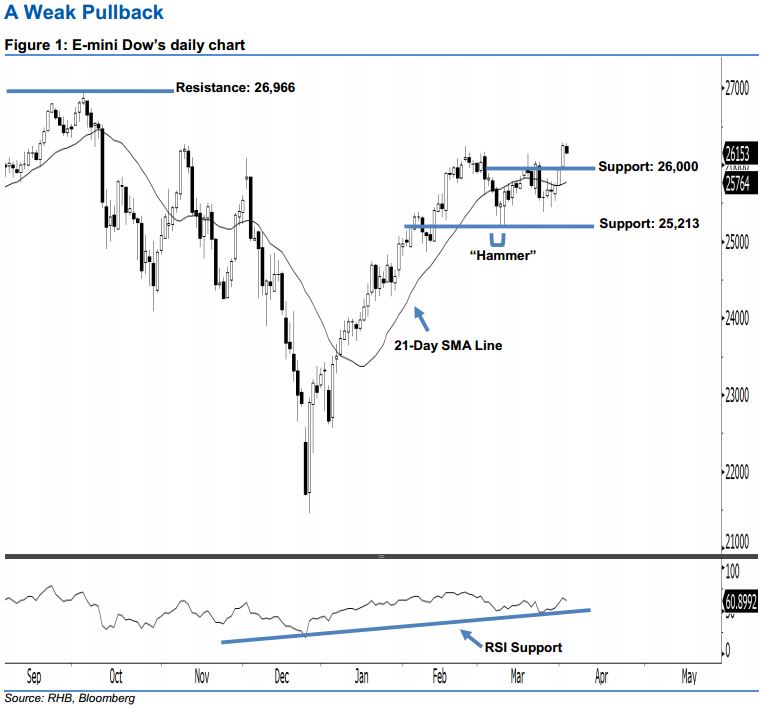

Stay long, with a stop-loss set below the 25,213-pt support. After posting three white candles in a row, the Emini Dow ended lower to form a black candle last night. It declined 105 pts to close at 26,153 pts after oscillating between a high of 26,280 pts and low of 26,126 pts. However, on a technical basis, yesterday’s black candle can be viewed as a weak pullback after the recent gains. We think the bulls may continue to control the market, given that the index did not negate the bullishness of 8 Mar’s “Hammer” pattern. Overall, we keep our bullish view on the E-mini Dow’s outlook.

As seen in the chart, we anticipate the immediate support at the 26,000-pt psychological spot. The next support will likely be at 25,213 pts, which was obtained from the low of 8 Mar’s “Hammer” pattern. Towards the upside, the immediate resistance is maintained at the 26,966-pt record high. If a breakout arises, the next resistance is seen at the 27,000-pt round figure.

As a result, we advise traders to maintain long positions, since we initially recommended initiating long above the 26,000-pt level on 2 Apr. In the meantime, a stop-loss can be set below the 25,213-pt threshold to limit the downside risk.

Source: RHB Securities Research - 3 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024