WTI Crude Futures - Bulls Are Still on the Weak Side

rhboskres

Publish date: Tue, 18 Jun 2019, 10:41 AM

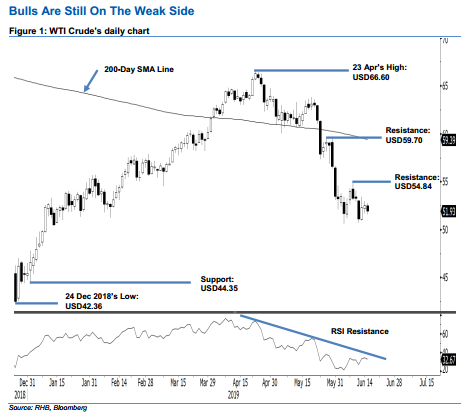

Stick with short positions in the absence of stronger rebound signals. The WTI Crude performed softly in the latest session – it eased USD0.58 to settle at USD51.93. The low and high were registered at USD51.58 and USD52.74. The commodity has been trading in a relatively narrow sideways consolidation pattern over the past two weeks, suggesting – at this juncture – that the probability for a stronger rebound to take place is still low. This consolidation phase developed after the black gold experienced a multi-week retracement that saw its daily RSI hitting an oversold reading. We maintain our negative trading bias.

As the negative trend has not shown signs of reaching an end, we retain our recommendation for traders to stay in short positions. These were initiated at USD61.81, or the closing level of 2 May. For risk-management purposes, a trailing-stop is placed above the USD54.84 level.

The immediate support is expected to emerge at USD50, a round figure. This is followed by USD44.35, which was the low of 2 Jan. Moving up, the immediate resistance is now pegged at USD54.84, the high of 10 Jun, followed by USD59.70, which was the high of 30 May.

Source: RHB Securities Research - 18 Jun 2019