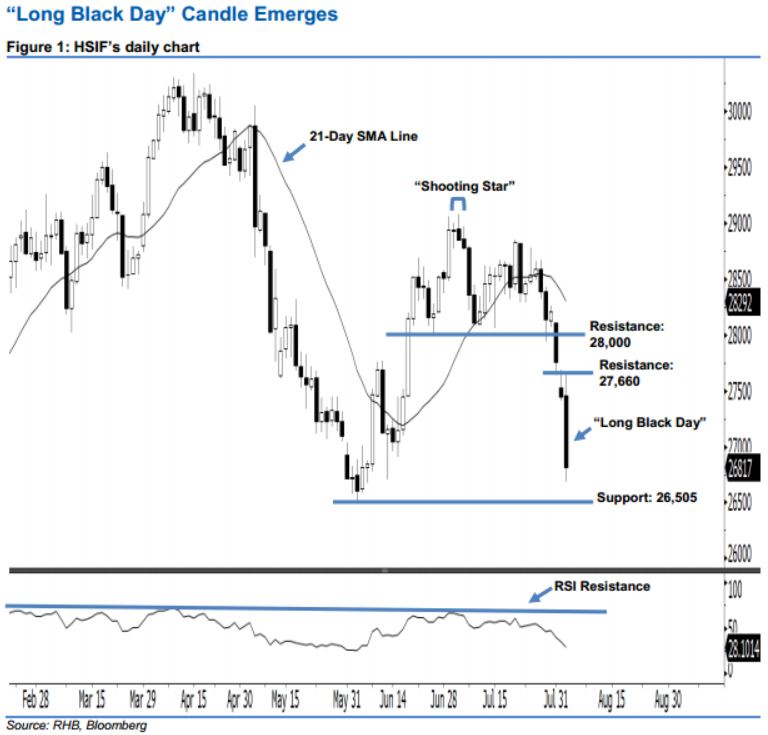

Hang Seng Index Futures - “Long Black Day” Candle Emerges

rhboskres

Publish date: Mon, 05 Aug 2019, 10:12 AM

Stay short, with a new trailing-stop set above the 27,660-pt level. The HSIF formed a “Long Black Day” candle last Friday, indicating that selling momentum could be strong. The index plunged 628 pts to close at 26,817 pts. From a technical perspective, market sentiment remains bearish, as the aforementioned black candle was the third in three consecutive sessions. This can also be viewed as a continuation of bears extending the downside swing from 4 Jul’s “Shooting Star” pattern. Overall, we keep our bearish view on the HSIF’s outlook.

As seen in the chart, we are now eyeing the immediate resistance at 27,660 pts, ie the high of 2 Aug’s “Long Black Day” candle. The next resistance is seen at the 28,000-pt round figure, also situated near 26 Jun’s low. Towards the downside, the near-term support is anticipated at 26,505 pts, ie the previous low of 4 Jun. This is followed by the 26,000-pt psychological spot.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 28,109-pt level on 1 Aug. For now, a new trailing-stop can be set above the 27,660-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 5 Aug 2019