E-mini Dow Futures - Upside Move Stays Intact

rhboskres

Publish date: Mon, 11 Nov 2019, 10:02 AM

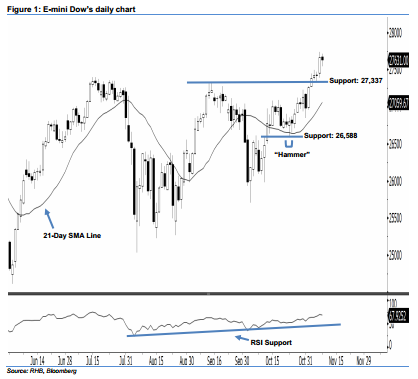

Stay long, with a new trailing-stop set below the 27,337-pt level. The E-mini Dow formed a black candle last Friday. It slipped 36 pts to close at 27,631 pts. Still, the bullish sentiment stays unchanged as this candle can only be viewed as buyers probably taking a breather after the recent surge. Since the 21-day SMA line is pointing upwards, this indicates that the upward momentum has not diminished thus far. Overall, we believe the upside swing that started off 23 Oct’s “Hammer” pattern would likely continue in the coming sessions.

According to the daily chart, we now anticipate the immediate support level at 27,337 pts, ie the low of 6 Nov. If this level is taken out decisively, look to 26,588 pts – ie the low of 23 Oct’s “Hammer” pattern – as the next support. Towards the upside, we are eyeing the near-term resistance level at the 28,000-pt psychological mark. This is followed by the 28,500-pt round figure.

To re-cap, on 16 Oct, we initially recommended traders to initiate long positions above the 26,750-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 27,337-pt threshold. This is in order to lock in part of the profits.

Source: RHB Securities Research - 11 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024