E-mini Dow Futures: a Slight Pullback

rhboskres

Publish date: Mon, 02 Dec 2019, 10:17 AM

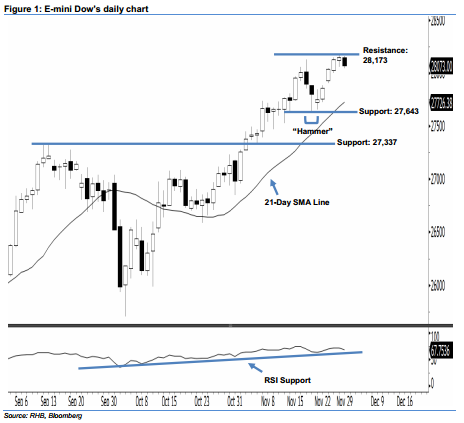

Bullish trend remains intact; stay long. After posting five positive candles in a row, the E-mini Dow ended lower to form a black candle last Friday. It slipped 75 pts to close at 28,073 pts after oscillating between a high of 28,158 pts and low of 28,042 pts. Unsurprisingly, last Friday’s black candle should merely be viewed as a weak pullback following the recent surge. Technically speaking, we think the bulls may continue to control the market – as long as the E-mini Dow does not negate the bullishness of the “Hammer” pattern created on 20 Nov. Overall, we keep our bullish view on the index’s outlook.

As shown in the chart, the immediate support level is seen at 27,643 pts, ie the low of 20 Nov’s “Hammer” pattern. If this level is taken out, look to 27,337 pts, which was determined from the low of 6 Nov. On the other hand, we are eyeing the immediate resistance level at the 28,173-pt record high. Meanwhile, the next resistance is anticipated at the 28,500-pt round figure.

Hence, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 26,750-pt level on 16 Oct. A trailing-stop set below the 27,643-pt threshold is advisable to secure part of the profits.

Source: RHB Securities Research - 2 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024