Hang Seng Index Futures - Downside Move Stays Unchanged

rhboskres

Publish date: Wed, 04 Dec 2019, 05:11 PM

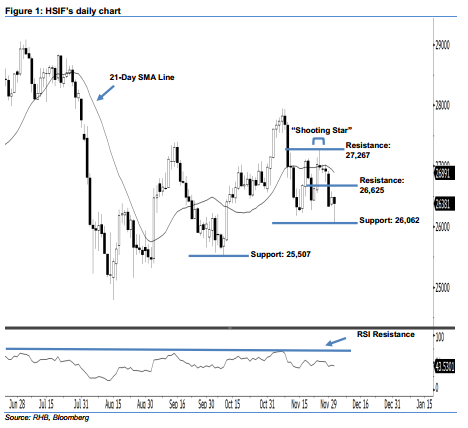

Bearish sentiment remains intact; stay short. The HSIF ended lower to form a black candle yesterday. It dropped to a low of 26,062 pts during the intraday session before ending at 26,381 pts for the day. Based on the current outlook, the index has been able to stay below the previously-indicated 27,267-pt resistance for more than a week, which implied that the sellers remain in control of the market. With the 21-day SMA line likely to begin turning downwards, this leads us to believe that the downside swing – which started off 26 Nov’s “Shooting Star” pattern – may persist. Overall, we remain bearish on the HSIF’s outlook.

According to the daily chart, we maintain the immediate resistance level at 26,625 pts, ie near the midpoint of 29 Nov’s long black candle. The next resistance is seen at 27,267 pts, which was the high of 26 Nov’s “Shooting Star” pattern. On the other hand, the immediate support level is now anticipated at 26,062 pts, or 3 Dec’s low. If a breakdown arises, the next support is situated at 25,507 pts – defined from the previous low of 10 Oct.

Therefore, we advise traders to maintain short positions, since we originally recommended initiating short below the 26,630-pt level on 22 Nov. A trailing-stop can be set above the 27,267-pt level to limit the risk per trade.

Source: RHB Securities Research - 4 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024