WTI Crude Futures - Back Above the 200-Day SMA

rhboskres

Publish date: Thu, 05 Dec 2019, 05:08 PM

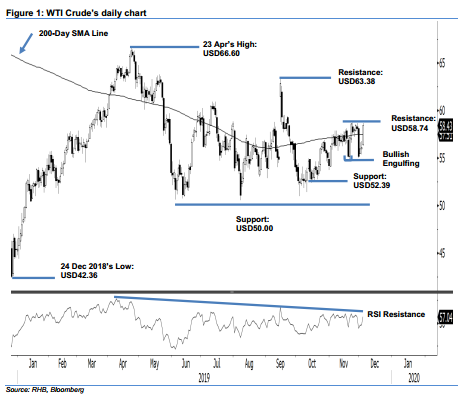

Maintain short positions while waiting for a clearer signal around the resistance level. The WTI Crude formed a white candle that, at the close, crossed above the 200-day SMA line. At one point, the black gold also came near to testing the USD58.74 immediate resistance with an intraday high of USD58.66. While prices have retuned back above said SMA line, to confirm that the commodity is ready for further upside potential, the aforementioned immediate resistance has to be crossed. Until this happens, we keep to our negative trading bias.

Pending signs that the bulls have regained control over the price trends, we continue to recommend traders stay in short positions – we initiated these at USD55.17, or the closing level of 29 Nov. For risk-management purposes, a stop loss can be placed above the USD58.74 mark.

Immediate support is set at USD54.76, which was the low of 20 Nov’s “Bullish Engulfing” formation. This is followed by USD52.39, or the low of 12 Oct. Meanwhile, immediate resistance is eyed at USD58.74, which was the high of 22 Nov. This is followed by USD63.38, ie the high of 16 Sep.

Source: RHB Securities Research - 5 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024