FKLI - Trailing Stop Holding Up

rhboskres

Publish date: Thu, 16 Jan 2020, 09:49 AM

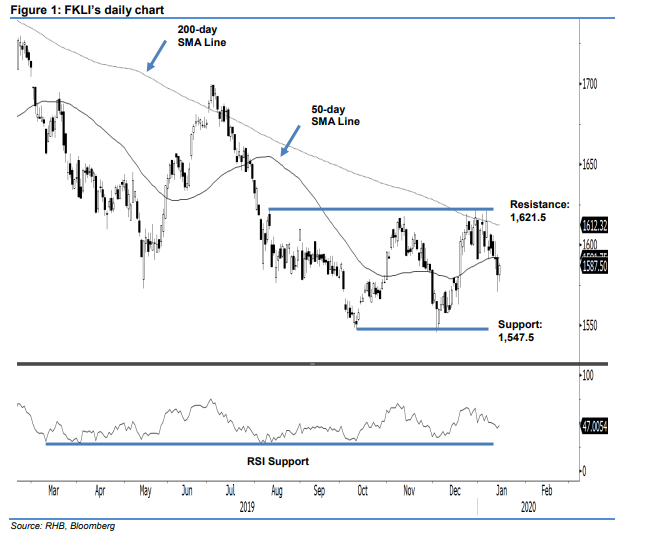

Maintain long positions. The FKLI ended the latest trade positively, adding 6 pts to close at 1,587.5 pts. The session’s low and high were recorded at 1,577 pts and 1,588.5 pts. The positive session means there is no negative follow-up from the prior session’s breakdown from the 50-day SMA line. As such, we still see the multi-month countertrend rebound that started from the low of 1,547.5 pts on 10 Oct 2019 as still in place. Towards the downside, a breach of the prior session’s low of 1,571 pts should signal the end of the said rebound. For now, stay with our positive trading bias.

In the absence of a negative price follow-up, traders should remain in long positions. We initiated these at 1,568 pts, the closing level of 6 Dec. To manage risks, a stop-loss can be placed below 1,571 pts.

The immediate support is set at 1,547.5 pts, the low of 10 Oct. This is followed by 1,500 pts, a round figure. Conversely, the immediate resistance is expected to emerge at the 1,600-pt mark, followed by 1,621.5 pts, the high of 9 Aug, followed by 1,650 pts

Source: RHB Securities Research - 16 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024