Hang Seng Index Futures : Downside Swing Remains Intact

rhboskres

Publish date: Thu, 23 Jan 2020, 04:18 PM

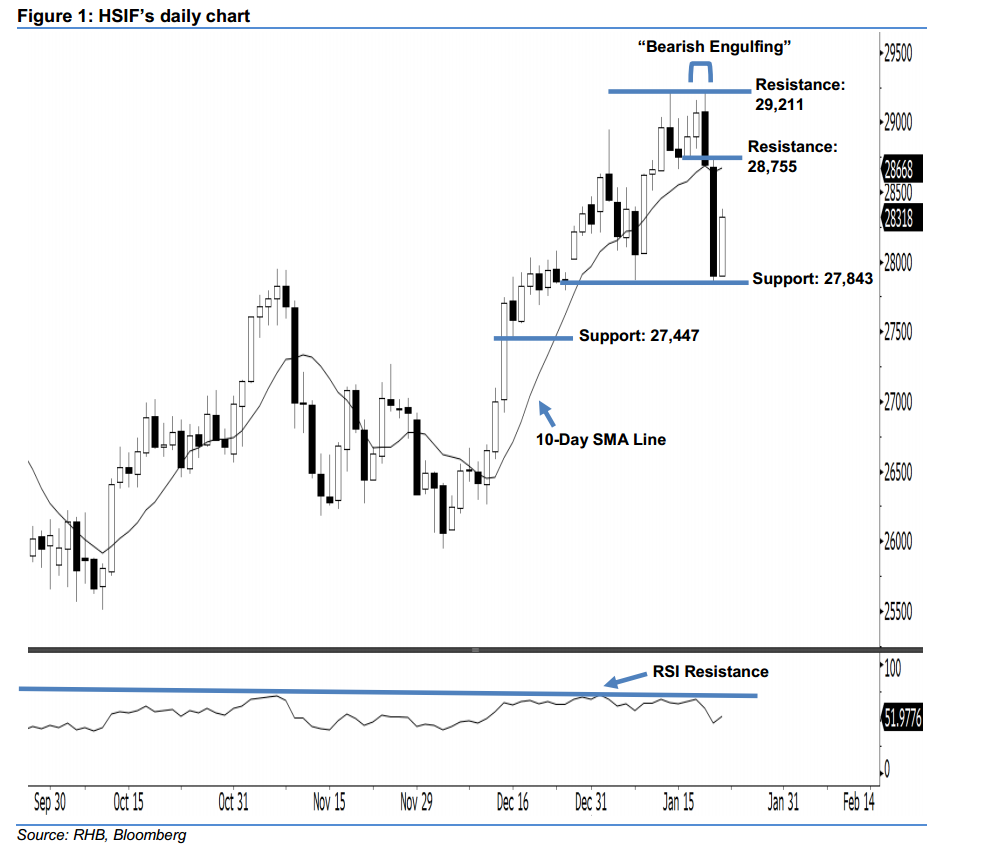

Maintain short positions. After posting two black candles in a row, the HSIF ended higher to form a white candle yesterday. It rose to a high of 28,379 pts during the intraday session, before ending at 28,318 pts for the day. However, from a technical basis, yesterday’s candle can be viewed as a technical rebound after the recent plunge. We think the bears may continue to control the market, given that the index did not recoup the losses from 21 Jan’s long black candle. Overall, we keep our bearish view on the HSIF’s outlook.

Presently, we are eyeing the immediate resistance level at 28,755 pts, which was the high of 21 Jan’s long black candle. The next resistance will likely be at 29,211 pts, ie the high of 20 Jan’s “Bearish Engulfing” pattern. On the other hand, the near-term support level is now anticipated at 27,843 pts, which was obtained from the low of 21 Jan. This is followed by 27,447 pts, ie the low of 16 Dec 2019.

Hence, we advise traders to stay short, following our recommendation of initiating short below the 28,300-pt level on 22 Jan. A stop-loss set above the 28,755-pt mark is advisable to minimise the risk per trade.

Source: RHB Securities Research - 23 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024