FCPO - Testing Immediate Resistance

rhboskres

Publish date: Fri, 07 Feb 2020, 04:36 PM

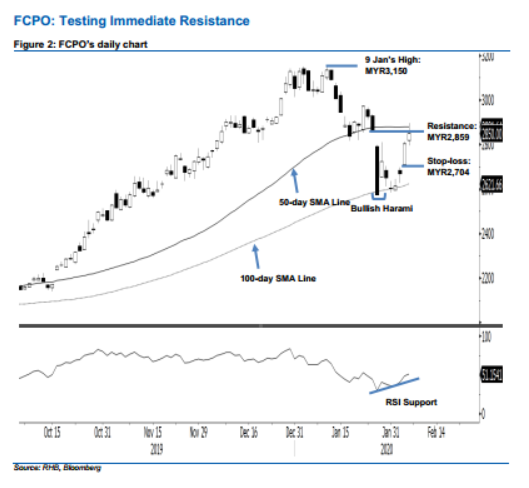

Maintain long positions, as the immediate resistance has been tested. The FCPO closed on a positive note yesterday, despite not being able to sustain a significant part of its intraday gains. The soft commodity reached a high of MYR2,895, and closed MYR46 higher at MYR2,850. It also means that the immediate resistance of MYR2,859 and the 50-day SMA line were briefly tested. However, there is no clear price rejection signal from the said levels. All in, we believe the commodity is in the process of staging a rebound, if not resuming its multi-month uptrend – after it recently completed its correction phase with the testing of the 100-day SMA line. We maintain our positive trading bias.

As the bulls continue to push prices higher, we maintain our long positions. These were initiated at MYR2,804, the closing level of 5 Feb. To manage risks, a stop-loss can be placed below MYR2,704.

The immediate support is revised to MYR2,810, the high of 29 Jan. This is followed by MYR2,752, derived from the 5 Feb candle. Meanwhile, immediate resistance is set at MYR2,859, the low of 24 Jan. This is followed by the MYR2,900 round figure.

Source: RHB Securities Research - 7 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024