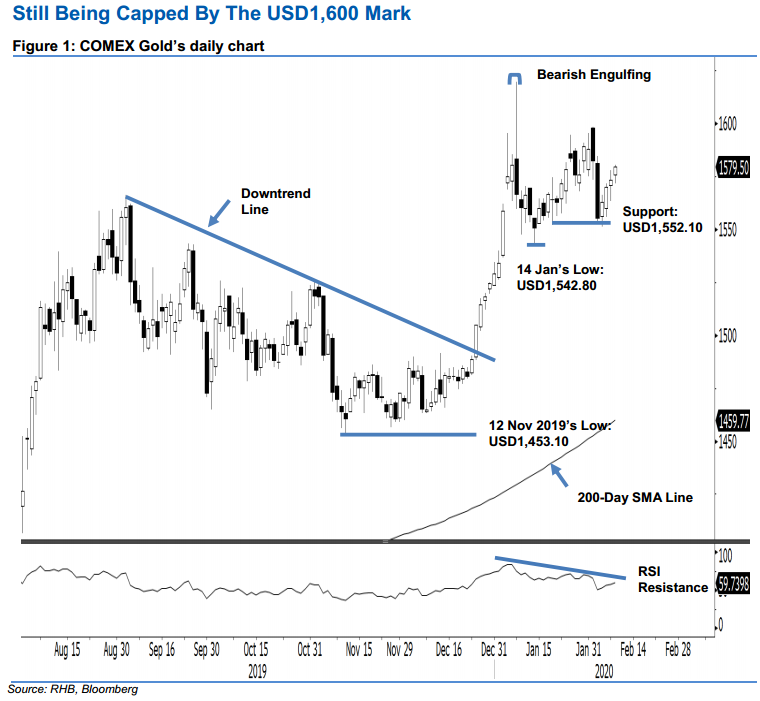

COMEX Gold - Still Being Capped by the USD1,600 Mark

rhboskres

Publish date: Tue, 11 Feb 2020, 09:40 AM

Maintain short positions, as the correction phase is still likely to extend. The COMEX Gold formed a fourth consecutive white candle during the latest trading session to settle USD6.10 stronger at USD1,579.50 – this crossed above the previous USD1,575 immediate resistance. While the precious metal is experiencing a rebound after recently testing the USD1.552.10 immediate support, we still see this as a reaction to the relatively sharp decline that occurred after it failed to cross above the USD1,600 mark on 3 Feb. We maintain our negative trading bias.

As the correction phase is still not seen as completed, we maintain our short position recommendation. We initiated these at USD1,555.50, or the closing level of 4 Feb. For risk-management purposes, a stop-loss can be placed above the USD1,600 level.

The immediate support is revised to USD1,563.50, which was the low of 7 Feb. This is followed by USD1,552.10, or the low of 21 Jan. Conversely, the immediate resistance is now pegged at the USD1,600 round figure. This is followed by USD1,619.60, ie the high of 8 Jan.

Source: RHB Securities Research - 11 Feb 2020

.png)

.png)