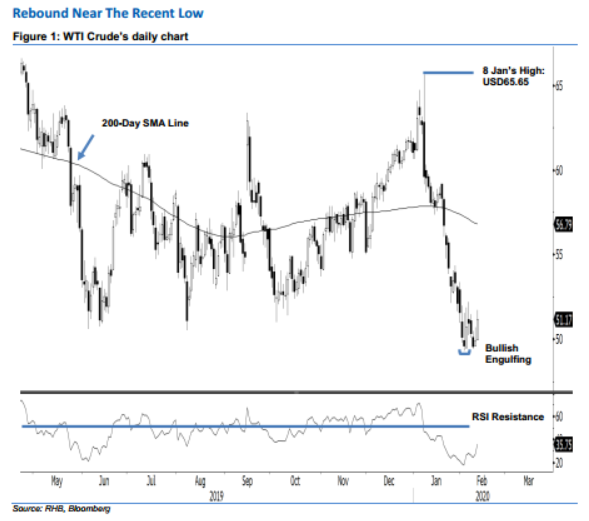

WTI Crude Futures - Rebound Near the Recent Low

rhboskres

Publish date: Thu, 13 Feb 2020, 04:34 PM

Maintain short positions as there is no trend reversal signal yet. The WTI Crude formed a second consecutive white candle to settle USD1.23 higher at USD51.17 – crossing above the previous immediate resistance of USD50.50. Trading took place in the range of USD51.17 and USD51.73. The second positive session came after the commodity came in near to test 4 Feb’s “Bullish Harami” low of USD49.31 a few sessions ago. However, we continue to observe the trend is still firmly negative. Hence, we are keeping our negative trading bias.

As the rebound is seen as just a pause by the bears, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can now be placed above the USD52.29 level.

The immediate support is set at USD50.30, derived from the latest candle. This is followed by USD49.31, or the low of 5 Feb’s “Bullish Engulfing” pattern. Moving up, the immediate resistance is now set at the USD51.50 threshold – derived from 10 Feb’s candle. This is followed by USD52.29, derived from 1 Feb’s candle.

Source: RHB Securities Research - 13 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024