E-mini Dow Futures: Short Positions Now Activated

rhboskres

Publish date: Tue, 25 Feb 2020, 11:24 AM

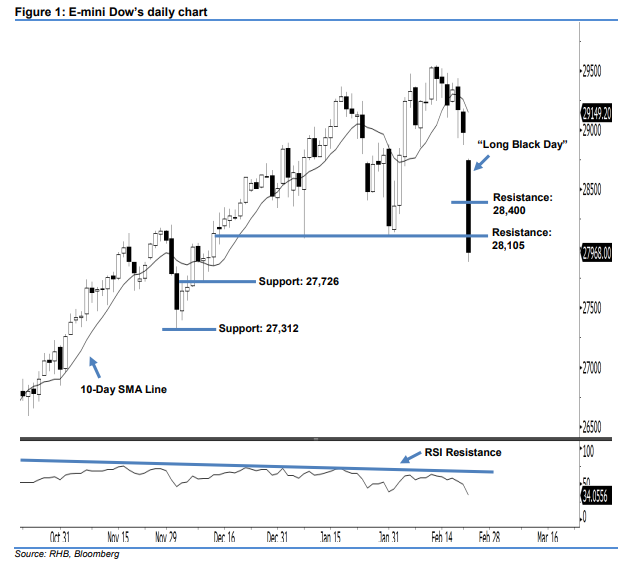

Initiate short positons below the 28,105-pt level. The E-mini Dow formed a “Long Black Day” candle, leaving a downside gap last night – indicating a strong selling momentum. It tumbled 1,013 pts to close at 27,968 pts. Technically, the index has posted a third consecutive black candle and hit its 2-month low, implying that the sentiment has turned bearish. This can also be viewed as a continuation of the sellers extending the downside swing from 13 Feb’s high. Meanwhile, 21 Feb’s closing also triggered our previous trailing-stop recommendation at the 29,100 threshold – which has captured part of the profit. Note that we initially advised traders to initiate long above the 28,600-pt level on 5 Feb.

We anticipate the resistance level at 28,105 pts, ie 31 Jan’s low. This is followed by 28,400 pts, set near the midpoint of 24 Feb’s “Long Black Day” candle. To the downside, we are eyeing the immediate support level at 27,726 pts, which was 10 Dec 2019’s low. The next support is seen at 27,312 pts, ie the previous low of 3 Dec 2019.

Hence, we advise traders to initiate short positions below the 28,105-pt level. A stop-loss can be set above the 28,400-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 25 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024