FCPO: Bulls Are Backing Off

rhboskres

Publish date: Tue, 25 Feb 2020, 11:35 AM

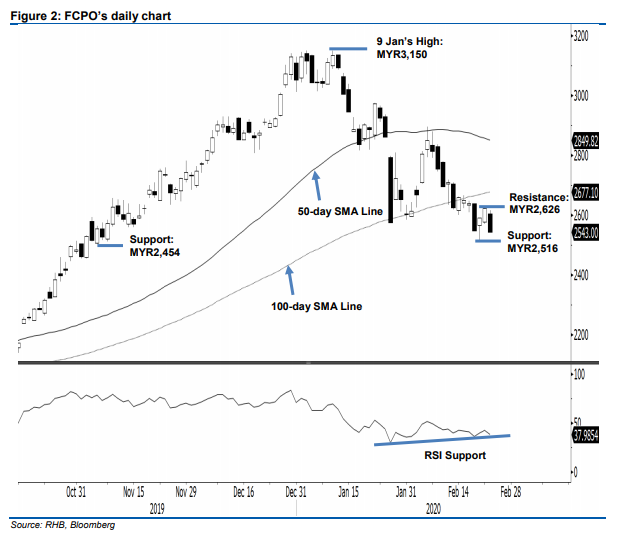

Maintain short positions as the bias is still negative. The FCPO shed MYR79 to close at MYR2,543, near the session’s low of MYR2,542. The closing level also placed the commodity below the previous support levels, ie MYR2,590 and MYR2,550. The negative session marked the end of the commodity’s prior two sessions’ rebound – and suggests that the risk of the retracement resuming is high. Towards the upside, we now believe that this negative bias will remain in place – as long as the commodity is still capped by the MYR2,626 level. Premised on this, we are keeping to our negative trading bias.

Since the bears are re-asserting control, traders are advised to remain in short positions. We initiated these at MYR2,695, the closing level of 11 Feb. To manage risks, a stop-loss can be placed above MYR2,626.

We revised the immediate support to MYR2,516, the low of 20 Feb, followed by MYR2,454, the low of 1 Nov 2019. Towards the upside, the immediate resistance is at MYR2,585, derived from the latest candle, followed by MYR2,626, the high of 21 Feb.

Source: RHB Securities Research - 25 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024