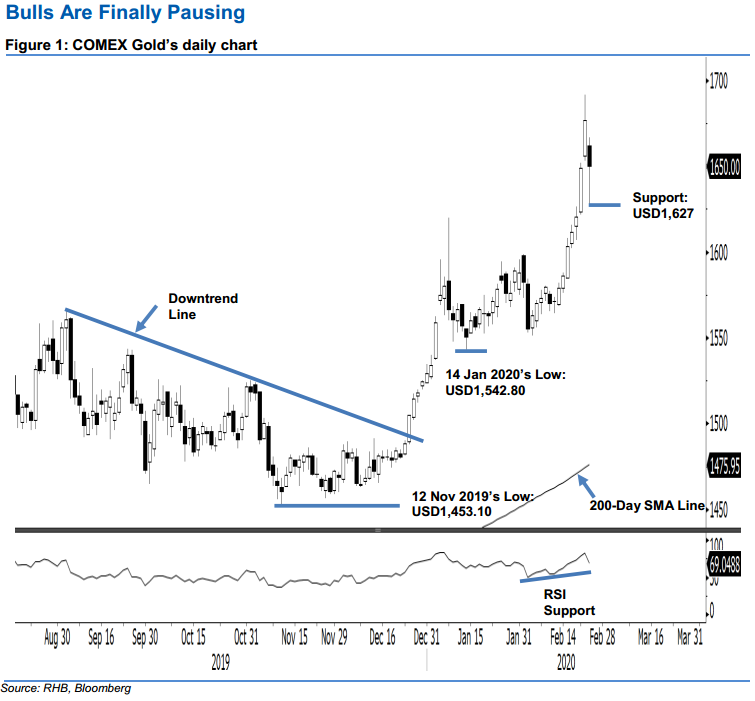

COMEX Gold - Bulls Are Finally Pausing

rhboskres

Publish date: Wed, 26 Feb 2020, 05:17 PM

Maintain long positions as the upward move is merely taking a pause. The COMEX Gold finally halted its over one-week upward move, settling USD26.60 lower at USD1,650 – breaching below the previous immediate support of USD,1655. The weak session came after the RSI reached an overbought reading in the prior session. For now, this can be seen as just profit-taking activity, and the session did not flash out a price exhaustion signal that could point towards a deeper correction. Maintain our positive trading bias.

On the bias that the bulls are merely taking a pause, we maintain our long recommendation. We initiated these at USD1,586.40, ie the closing level of 13 Feb. For risk-management purposes, a stop-loss can be placed at USD1,620.

The immediate support is revised to USD1,627, derived from the latest low. This is followed by the USD1,600 round figure. Moving up, the immediate resistance is revised to USD1,670, followed by the USD1,700 round figure.

Source: RHB Securities Research - 26 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024