COMEX Gold - Just a Bounce

rhboskres

Publish date: Tue, 03 Mar 2020, 10:12 AM

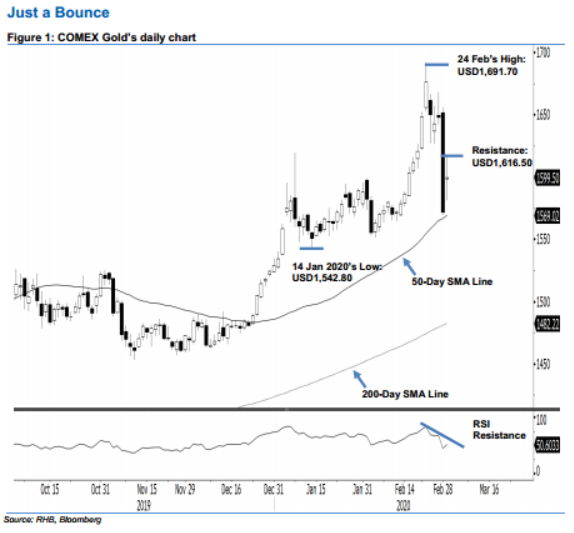

Maintain short positions as the bearish bias is still in place. The COMEX ended the latest session on a positive note. Trading ranged between USD1,581.20 and USD1,616.50, before it closed at USD1,599.50 – below the USD1,600 resistance mark. The positive session can be seen as just a pause by the bears after the prior session’s sharp decline which pushed the commodity to come in near to test the 50-day SMA line. At this juncture, we still believe the commodity’s correction phase may still be carrying on. Maintain our negative trading bias.

As we have yet to see the bulls regaining control over the price trend, we recommend traders to stay in short positions. We initiate short positions at USD1,571.820, the closing level of 28 Feb. For risk management purposes, a stop-loss can be placed above the USD1,600 mark.

We revised the immediate support to USD1,590 – derived from the latest candle, followed by USD1,580. Towards the upside, the immediate resistance is revised to the USD1,600 round figure. This is followed by USD1.616.50, the latest session’s high.

Source: RHB Securities Research - 3 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024