WTI Crude Futures - A Sharp Intraday Price Reversal

rhboskres

Publish date: Tue, 03 Mar 2020, 10:14 AM

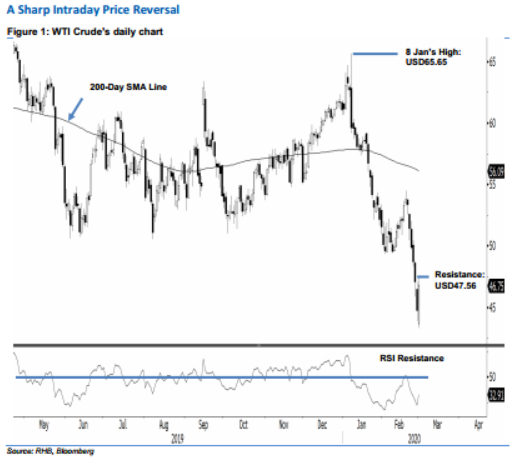

Maintain short positions until further positive price signals emerge. The WTI Crude experienced a strong intraday price reversal, as it spiked from a low of USD43.32 to settle USD1.99 stronger at USD46.75 – crossing above our previous immediate resistance of USD46. The sharp intraday positive price reversal came in after the support levels of USD43.85 and USD43.36 were briefly – on the back of an oversold RSI reading. Pending further positive price actions to signal a possible stronger rebound, we are keeping our negative trading bias.

As further evidence is needed to confirm a stronger rebound, we recommend traders to stay in short positions. We initiated these at USD49.90, the closing level of 25 Feb. To manage the risk, a stop-loss can be placed above USD47.56.

We revised the immediate support to USD46.40, followed by USD44.80 – both are derived from the latest candle. Moving up, resistance points are pegged at USD47.56 – the latest high, followed by USD48.78, the price point of 27 Feb.

Source: RHB Securities Research - 3 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024