COMEX Gold : a Washout Session

rhboskres

Publish date: Fri, 13 Mar 2020, 09:29 AM

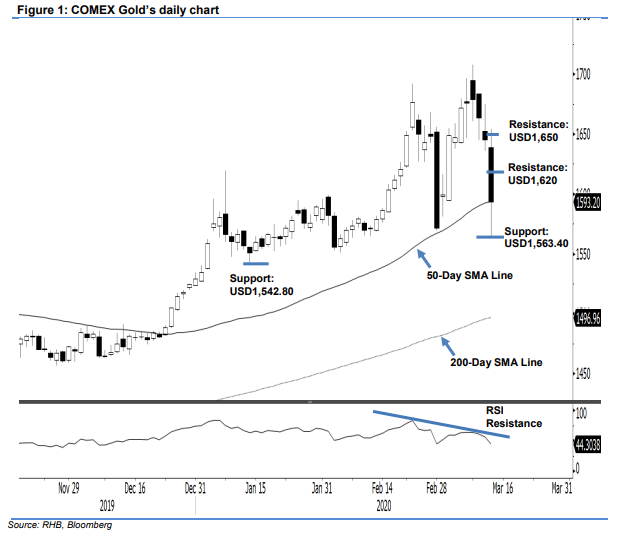

Initiate short positions, as the price rejection has been confirmed. The COMEX Gold experienced a sharp drop during its latest session – where we witnessed the previous USD1,640 and USD1,620 support levels being breached. Trading was wide – between USD1,563.40 and USD1,654 – before settling USD52.20 lower at USD1,593.20. The latter is also at the 50-day SMA line. This negative session confirmed our suspicions that the commodity was at risk of experiencing a price rejection from the USD1,691.70 mark. Premised on this, we switch our trading bias to negative.

Our previous long positions – initiated at USD1,648.90, or the closing level of 3 Mar – were closed out at USD1,640 during this latest session. As the correction phase has set in, we initiate short positions at the latest close. For riskmanagement purposes, a stop-loss can be placed above USD1,650 mark.

The immediate support is revised to USD1,563.40, or the latest low. This is followed by USD1,542.80, ie the low of 14 Jan. Towards the upside, the immediate resistance is revised to USD1,620, and is followed by USD1,650 – both are derived from the latest candle.

Source: RHB Securities Research - 13 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024