FKLI - Bulls Are Back

rhboskres

Publish date: Wed, 25 Mar 2020, 05:36 PM

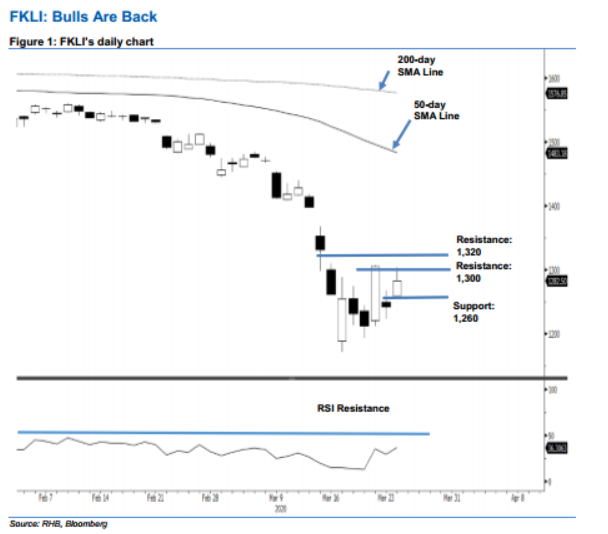

Initiate long positions as the bulls continue to hold on. The FKLI staged a strong comeback in the latest session, ending 40.5 pts to close at 1,282.5 pts. The index also briefly tested the 1,300-pt mark. The strong performance came after the prior session’s sharp decline and has triggered the signal that the recent sessions’ counter-trend rebound is still developing. This ongoing rebound phase is meant to correct the index’s previous multi-month sharp retracement which reached an oversold RSI reading. Hence, we switch our trading bias to positive.

Our previous short positions initiated at 1,242 pts on 23 Mar were closed at 1,268 pts in the latest session. As the bulls are again signalling that the multi-sessions’ rebound is still in effect, we initiate long positions at the latest close. For risk management purposes, a stop-loss can be placed below 1,260 pts.

We revised the immediate support to 1,275 pts – price point of the latest session. This is followed by 1,260 pts, price point of 23 Mar. Moving up, the immediate resistance is eyed at 1,300-pt round figure, this is followed by 1,320 pts, price point of 13 Mar.

Source: RHB Securities Research - 25 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024