Hang Seng Index Futures - Initiate Long Positions

rhboskres

Publish date: Wed, 25 Mar 2020, 05:39 PM

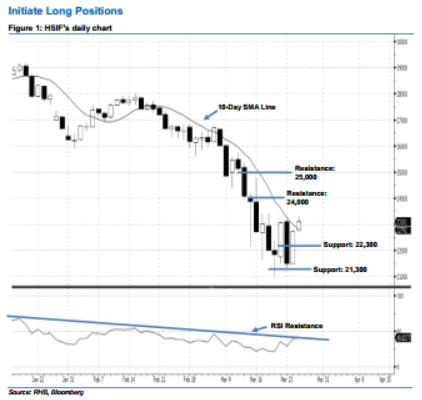

Initiate long positions above the 22,300-pt level. At the time of writing, the HSIF was forming another white candle. At yesterday’s close, the index rose 1,232 pts to settle at 22,728 pts. From a technical viewpoint, the HSIF has recouped most of the losses from 23 Mar’s long black candle and hit its 1-week high – an indication that sentiment is still considered positive. In addition, the index is now climbing above the 10-day SMA line, enhancing the positive sentiment as well. Meanwhile, 23 Mar’s closing also triggered our stop-loss, which we previously recommended that investors set at the 21,500-pt threshold.

Presently, we are eyeing the immediate support level at 22,300 pts, which is situated near the midpoint of 24 Mar’s white candle. The next support will likely be at 21,300 pts, ie near the low of 23 Mar. On the other hand, we are eyeing the near-term resistance level at the 24,000-pt round figure. This is followed by 25,000-pt psychological mark.

Therefore, we advise traders to initiate long positions above the 22,300-pt level. A stop-loss can be set below the 21,300-pt threshold to limit the downside risk.

Source: RHB Securities Research - 25 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024