WTI Crude Futures - Still Capped by the Immediate Resistance

rhboskres

Publish date: Wed, 25 Mar 2020, 05:40 PM

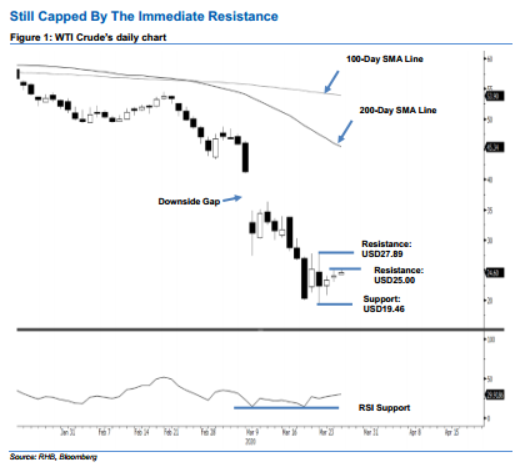

Negative trend not showing signs of reaching an end; maintain short positions. The WTI Crude posted a second consecutive positive closing in the latest session to settle at USD24.82 – slightly below the immediate resistance of USD25.00. Trading ranged between USD24.20 and USD25.10. Despite the extension of the rebound from the USD19.45 support level, it is still insufficient to signal that a strong rebound or a total price reversal is in the process of developing. Hence, we are keeping our negative trading bias.

As we are not seeing evidence to suggest the retracement has reached its low, we are staying with our recommendation that traders stay in short positions. We initiated these at USD31.50, or the closing level of 12 Mar. To manage the risk, a stop-loss can be placed at above the USD27.89 level.

The immediate support is set at USD23.00 – derived from 23 Mar’s candle. This is followed by USD19.46, or the low of 20 Mar. Moving up, the immediate resistance is still set at USD25.00 and followed by USD27.89 – the high of 20 Mar.

Source: RHB Securities Research - 25 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024