E-mini Dow Futures - Long Positions Now Activated

rhboskres

Publish date: Thu, 26 Mar 2020, 07:38 PM

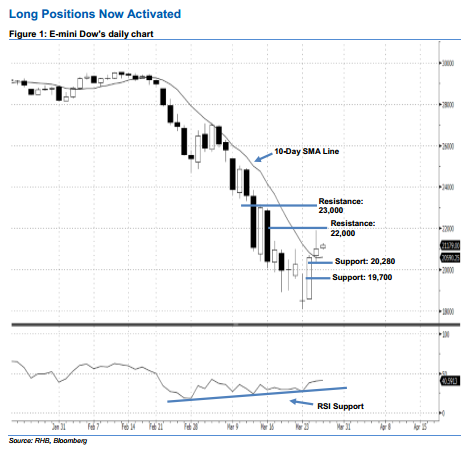

Initiate long positions above the 20,280-pt level. At last night’s close, the E-mini Dow ended higher to form another white candle. It gained 418 pts to settle at 21,026 pts. From a technical perspective, the index has closed above the 21,000-pt threshold and 10-day SMA line, implying that sentiment is turning positive. Last night’s white candle also sent the E-mini Dow to its highest point in more than a week, enhancing the positive sentiment. 25 Mar’s closing also triggered our previous trailing-stop recommendation at the 21,000-pt mark – which has locked in part of the profits. Note we initially advised traders to initiate short below the 24,675-pt level on 10 Mar.

As seen in the chart, the immediate support level is seen at 20,280 pts – this was determined near 25 Mar’s low. The next support is anticipated at 19,700 pts, which is set near the midpoint of 24 Mar’s long white candle. On the other hand, we are eyeing the immediate resistance level at the 22,000-pt psychological mark. Meanwhile, the next resistance will likely be at the 23,000-pt round figure, ie near 13 Mar’s high as well.

Therefore, we advise traders to initiate long positions above the 20,280-pt level. A stop-loss can be set below the 19,700-pt threshold to limit the downside risk.

Source: RHB Securities Research - 26 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024