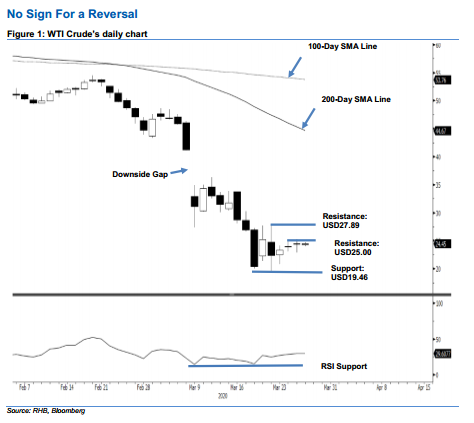

WTI Crude Futures - No Sign for a Reversal

rhboskres

Publish date: Thu, 26 Mar 2020, 07:41 PM

Maintain short positions as the trend remains negative. The WTI Crude ended the latest session better by USD0.48 at USD24.49. Despite the positive closing, the black gold is still not able to overcome the immediate resistance of USD25.00, which it has been attempting to cross above over the latest two sessions. We believe the commodity’s retracement leg has yet to reach its end, despite the recent rebound off the recent low of USD19.46.

Maintain our negative trading bias. Until there are clearer signals to suggest a stronger rebound is taking place, we are staying with our recommendation that traders stay in short positions. We initiated these at USD31.50, or the closing level of 12 Mar. To manage the risk, a stop-loss can be placed at above the USD27.89 level.

We are keeping the immediate support at USD23.00 – derived from 23 Mar’s candle. This is followed by USD19.46, or the low of 20 Mar. Towards the upside, the immediate resistance is expected at USD25.00 and followed by USD27.89 – the high of 20 Mar.

Source: RHB Securities Research - 26 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024