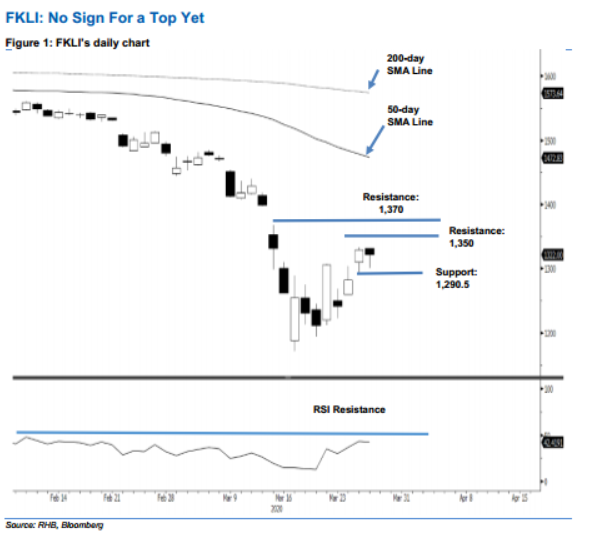

FKLI - No Sign For a Top Yet

rhboskres

Publish date: Fri, 27 Mar 2020, 04:26 PM

Counter-trend rebound may still be extending; maintain long positions. The FKLI managed to narrow its losses in the latest session, as it bounced off from a low of 1,300 pts to close at 1,322 pts – indicating a decline of 7.5 pts. We are not seeing signs of the index’s counter-trend rebound reaching a top given it managed to significantly narrow its intraday losses. The ongoing rebound is meant to correct the index’s previous multi-month sharp retracement. Hence, we are keeping our negative trading bias.

As we have yet to see signs of a rebound top, we recommend traders to stay in long positions. We initiated these at 1,282.5 pts, the closing level of 24 Mar. For risk management purposes, a stop-loss can be placed at the breakeven mark.

The immediate support is maintained at 1,310 pts, followed by 1,290.5 pts – both are derived from the 25 Mar’s candle. Towards the upside, the immediate resistance is now pegged at 1,350 pts, followed by 1,370 pts.

Source: RHB Securities Research - 27 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024