FCPO - Bulls Are Clinging On

rhboskres

Publish date: Fri, 27 Mar 2020, 04:27 PM

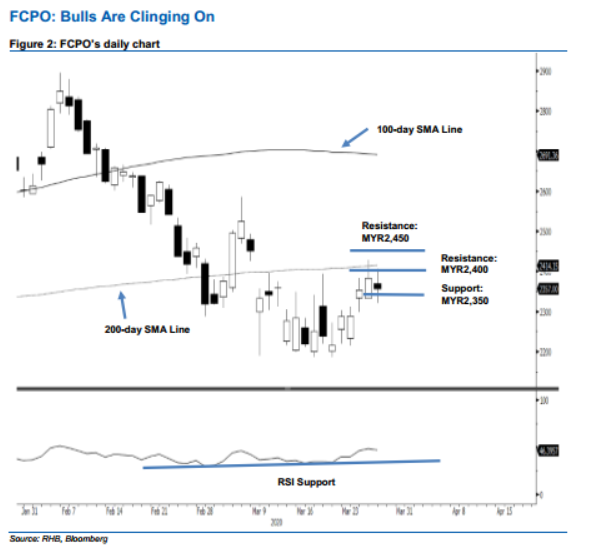

Maintain long positions as there is no clear price rejection signal from 200-day SMA. The FCPO settled the latest session MYR26 lower at MYR2,357. At one point, it reached a low of MYR2,320. The negative session came after the commodity tested the 200-day SMA line in the prior session. At this juncture, there is still insufficient evidence to suggest a possible price rejection from the said SMA line, which the bulls have been attempting to cross since early March. Premised on this, we are keeping our positive trading bias.

With no confirmation to suggest the rebound has reached its top, we recommend traders stay in long positions. To manage risks, a stop-loss can be placed at the breakeven mark.

We keep the immediate support at MYR2,350. This is to be followed by the MYR2,300 round figure. Moving up, the immediate resistance is maintained at the MYR2,400 round figure, also near the 200-day SMA line. This is followed by MYR2,450.

Source: RHB Securities Research - 27 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024