WTI Crude Futures - the Sliding Mode Resumes

rhboskres

Publish date: Mon, 30 Mar 2020, 10:33 AM

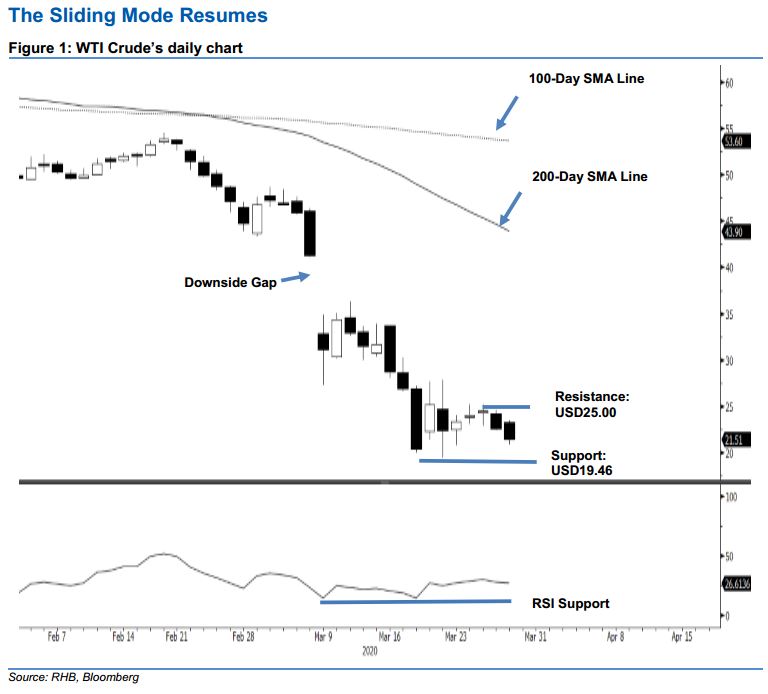

The bears are waking up again; maintain short positions. The WTI Crude registered a weak close during its latest trade, giving up USD1.09 to close at USD21.51. Trading reached a low and high of USD20.88 and USD23.44. The latest two session’s weak performances likely indicated that a bearish trend was resuming after the recent brief rebound. While the RSI reading is indicating an oversold condition, price signals continue to indicate that the bearish trend is likely to extend. Premised on this, we are sticking with our negative trading bias.

On the observation that the bears are having firm control over the price trend, we are staying with our recommendation that traders stay in short positions. We initiated these at USD31.50, or the closing level of 12 Mar. To manage the risk, a stop-loss can be placed at above the USD25.00 threshold.

We revised the immediate support to USD19.46, or the low of 20 Mar. This is followed by the USD18.00 round figure. Moving up, the immediate resistance is eyed at USD23.00 and followed by USD25.00.

Source: RHB Securities Research - 30 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024