WTI Crude Futures - the Bears Are in Firm Control

rhboskres

Publish date: Tue, 31 Mar 2020, 10:47 AM

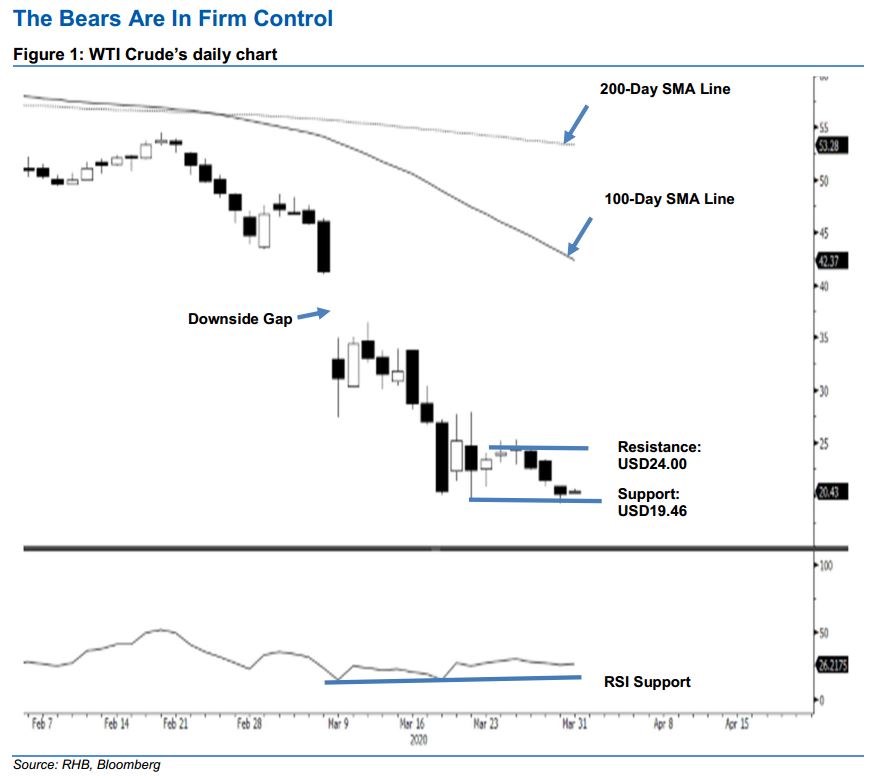

Maintain short positions, as there is no sign of a low yet. The WTI Crude tested the USD19.46 support level with a low of USD19.27, before narrowing its losses to close at USD20.09. The negative session is signalling that the commodity’s bearish bias remains in place without showing any signs of reaching its low yet. This is despite the RSI still flashing out an oversold reading. Until there are clear signs of a strong rebound appearing, we are keeping our negative trading bias.

As the WTI Crude is still searching for its low, we are staying with our recommendation that traders stay in short positions. We initiated these at USD31.50, or the closing level of 12 Mar. To manage the risk, a stop-loss can be placed above the USD24.00 threshold.

The immediate support is eyed at USD19.46, or the low of 20 Mar. This is followed by the USD18.00 round figure. Moving up, the immediate resistance is now pegged at USD22.00, ie price point of 27 Mar. This is followed by the USD24.00 level.

Source: RHB Securities Research - 31 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024