FCPO - Crossing The 200-Day SMA Line

rhboskres

Publish date: Tue, 31 Mar 2020, 11:14 AM

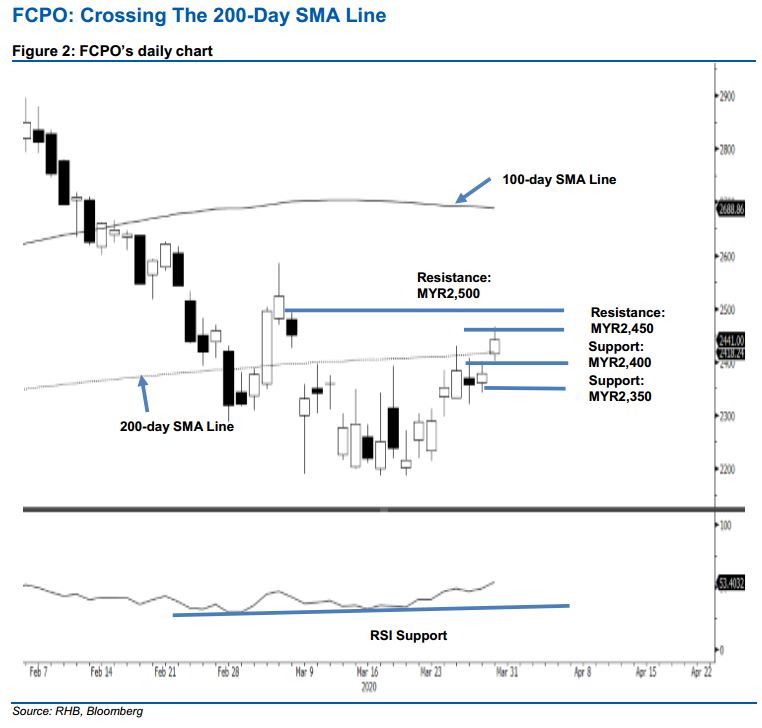

Maintain long positions as the bulls crossed the important SMA line. The FCPO flashed out an important positive price signal in the latest session, as it finally crossed above the 200-day SMA line, after multi attempts since the beginning of March. The commodity closed MYR63 higher at MYR2,441, after hitting a low and high of MYR2,402 and MYR2,466. The positive price signal is suggesting that the bulls are still in control over the commodity’s rebound, which started from the low of MYR2,186 on 19 Mar. As long as no sign of a possible price rejection from the said SMA happens in the coming sessions, we would likely retain our positive trading bias.

As the rebound is showing signs of progressing, we recommend traders stay in long positions. To manage risks, a stop-loss can be placed at the breakeven mark.

We revise the immediate support to the MYR2,400 round figure, this is followed by MYR MYR2,350. Towards the upside, the immediate resistance is now eyed at the MYR2,450 threshold. This is followed by the MYR2,500 round figure.

Source: RHB Securities Research - 31 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024