FKLI - Rebound Still Has Legs

rhboskres

Publish date: Tue, 31 Mar 2020, 11:14 AM

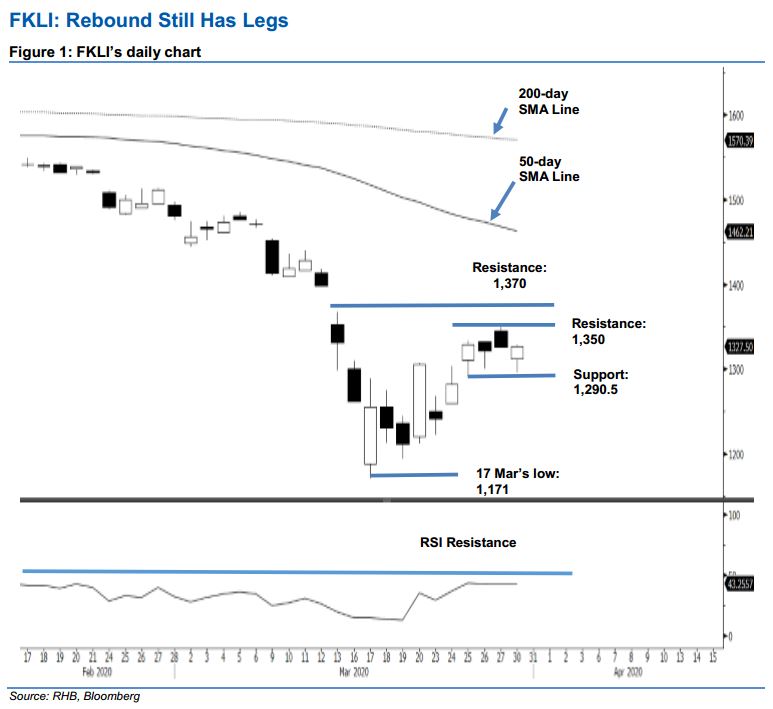

Counter-trend rebound may still be extending; maintain long positions. The FKLI managed to reverse its fortune in the latest session. It rebounded from a low of 1,296.5 pts to settle 1.5 pts higher at 1,327.5 pts. The encouraging positive intraday price reversal is a signal that the bulls still have firm control over the index’s counter-trend rebound, which stated from the low of 1,171 pts on 17 Mar. This rebound is meant to correct the index’s previous multi-month retracement phase that reached an oversold RSI reading two weeks ago. Premised on this, we are keeping our positive trading bias.

As the latest price signal is still pointing towards the possibility of the rebound extending further, we recommend traders stay in long positions. We initiated these at 1,282.5 pts, ie the closing level of 24 Mar. For risk management purposes, a stop-loss can be placed at the breakeven mark.

We are keeping the immediate support at 1,310 pts, followed by 1,290.5 pts – both were derived from 25 Mar’s candle. Meanwhile, the immediate resistance is expected at 1,350 pts and followed by 1,370 pts.

Source: RHB Securities Research - 31 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024