COMEX Gold - Moving the Trailing-Stop

rhboskres

Publish date: Wed, 01 Apr 2020, 05:54 PM

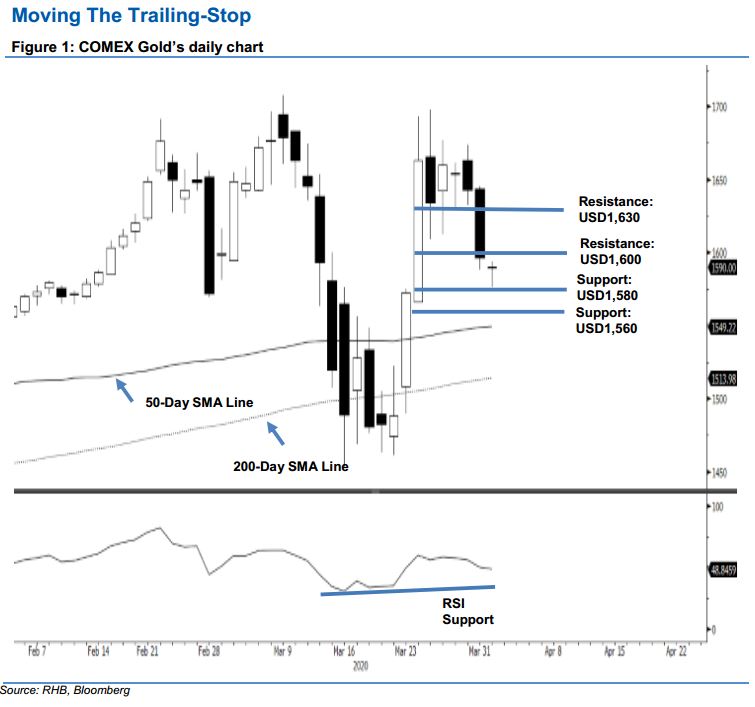

Maintain long positions while tightening up the trailing-stop, as the risk of a deeper correction developing increases. The COMEX Gold ended the latest session sharply lower – by USD46.90 – to close at USD1,596.60. This was below the previous two support levels of USD1,630 and USD1,600. The sharp decline has increased the risk of the commodity experiencing a deeper-than-expected correction phase. This phase is meant to correct the previous sharp upward move, which took place between 20 Mar and 25 Mar. Pending confirmation that a deeper correction is indeed taking place, we are sticking with our positive trading bias for now.

We advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,580 mark.

We revise the immediate support to USD1,580. This is followed by the USD1,560 level. Moving up, the resistance point is now pegged at USD1,600, and followed by the USD1,630 threshold.

Source: RHB Securities Research - 1 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024