COMEX Gold - Bouncing Off From the Immediate Support

rhboskres

Publish date: Thu, 02 Apr 2020, 04:27 PM

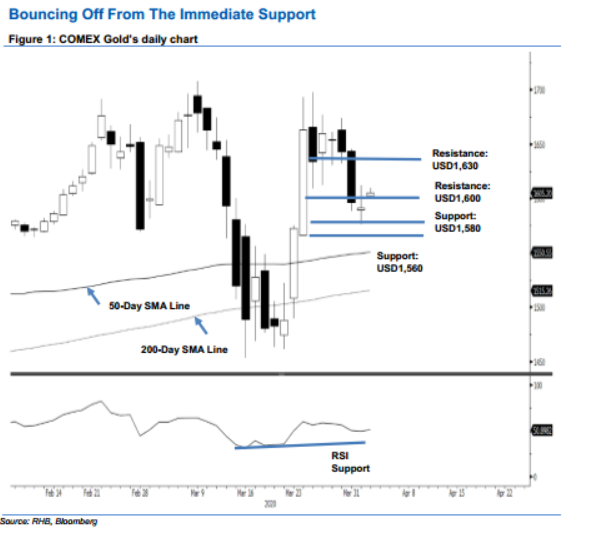

The bulls are still hanging on; maintain long positions. The COMEX Gold reached the immediate support of USD1,580 with a low of USD1,576, before it rebounded to settle the day at USD1,591.70 – indicating a decline of USD4.90. The precious metal has been undergoing a correction phase in the form of a relatively deep retracement over the past week or so. Provided the said immediate support is not breached to the downside, we still believe the commodity’s uptrend is still in place. Additionally, prices are still holding above both the 50-day and 200-day SMA lines – both of which are still curving upward. Maintain our positive trading bias.

With the bulls managing to defend the said immediate support, we advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,580 mark.

We are keeping the immediate support at USD1,580. This is followed by the USD1,560 level. Conversely, the resistance point is now pegged at USD1,600, followed by the USD1,630 threshold.

Source: RHB Securities Research - 2 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024