FKLI: Counter - Trend Rebound Ending?

rhboskres

Publish date: Thu, 02 Apr 2020, 04:43 PM

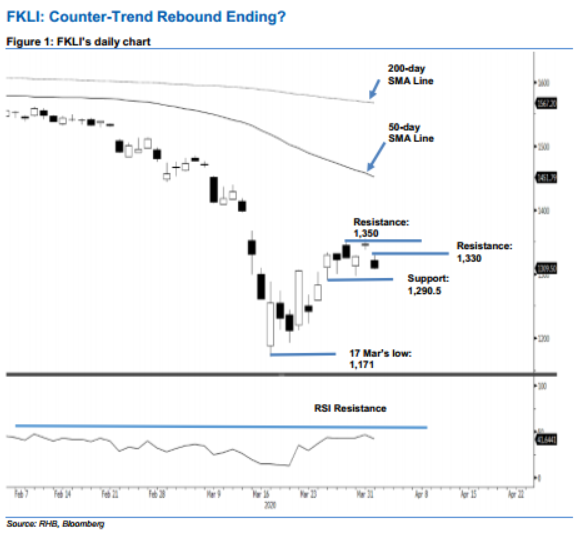

Initiate short positions as the rebound has potentially reached a top. The FKLI ended the latest session 22.5 pts lower at 1,309.5 pts. Trading ranged between 1,307.5 pts and 1,329.5 pts. With the index crossing below the previous immediate support of 1,320-pts, the risk is high that the index’s two weeks counter-trend rebound has probably completed its full swing, with the failed attempt to breach above the 1,350-pts recently. This means chances are high that the index is on the path of resuming its downtrend trend. This negative bias is further supported by both the 50-day and 200-day SMA lines which continued to trend lower despite the recent rebound. Switch our trading bias to negative.

Our previous long positions initiated at 1,282.5 pts, ie the closing level of 24 Mar were closed out at 1,320 pts. We initiate short positions at the latest closing. For risk management purposes, a stop-loss can be placed above the 1,350- pt mark.

We revised the immediate support to 1,300 pts, followed by 1,290.5 pts – the low of 25 Mar. Towards the upside, the immediate resistance is pegged at 1,330 pts, near the latest high, followed by 1,350-pts.

Source: RHB Securities Research - 2 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024