FKLI - Moving Down Stop-Loss

rhboskres

Publish date: Fri, 03 Apr 2020, 04:44 PM

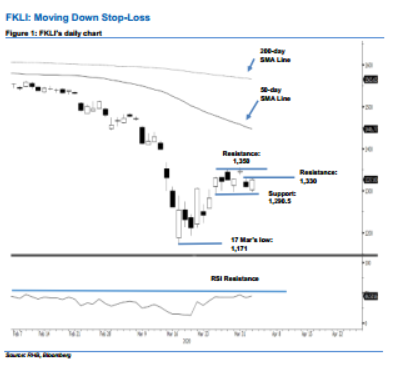

Maintain short positions while tightening up stop-loss. The FKLI ended the latest session stronger by 17.5 pts at 1,327 pts after it managed to reverse from the earlier session’s weakness. The high was posted at 1,329 pts, slightly below the immediate resistance of 1,330 pts. The relatively strong price reaction came after the index experienced two sessions of retracement. However, at this juncture, we believe the index is still at risk of resuming its downtrend move – this was after it recently failed to cross above the 1,350-pts level which we see as a negative price signal. For now, as long as the index is still capped by the said immediate resistance, we maintain our negative trading bias.

We retain our recommendation for traders to stay in short positions. We initiated these at 1,309.5 pts, the closing level of 1 Apr. For risk management purposes, a stop-loss can be placed above the 1,330-pt mark.

The immediate support is set at 1,313 pts – the price point of the latest session. This is followed by 1,290.5 pts – the low of 25 Mar. Moving up, the immediate resistance is set at 1,330 pts, near the latest high, followed by 1,350-pts.

Source: RHB Securities Research - 3 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024