FCPO - Support Levels Give Way

rhboskres

Publish date: Mon, 06 Apr 2020, 09:35 AM

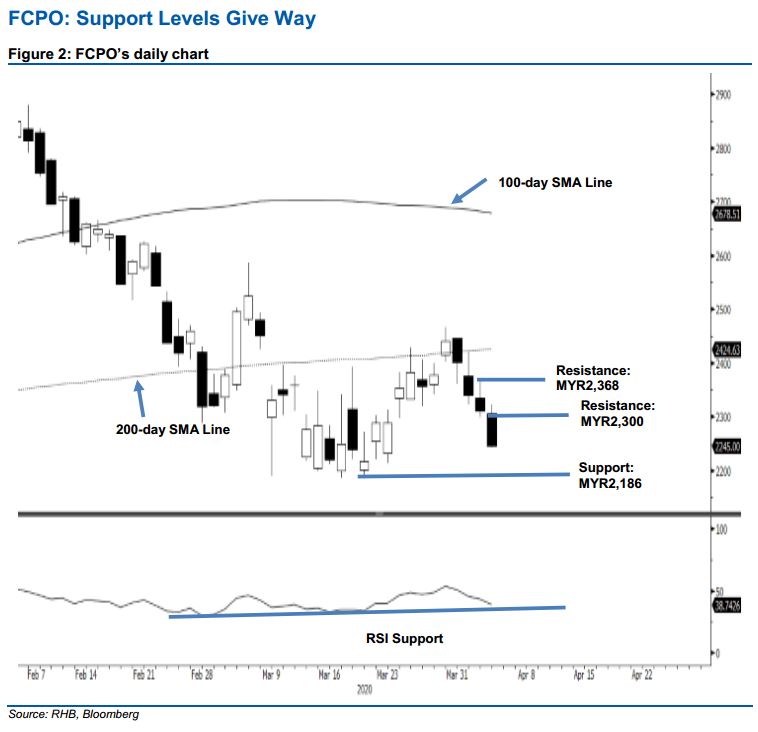

Maintain short positions while tightening up risk management. The FCPO continued to slide in the latest session, giving up MRY66 to close at MYR2,245. The closing price also placed the commodity below the previous support levels of MYR2,300 and MYR2,250. The breakdown of the said supports is a continuation from the price rejection from the 200-day SMA line, which happened on 1 Apr. The 100-day SMA line turning downwards, is also suggesting a bearish trend. In the absence of a price reversal, we are keeping our negative trading bias.

As the retracement phase is showing a good sign of progressing, we keep to our recommendation for traders to stay in short positions. We initiated these at MYR2,339, the closing level of 1 Apr. To manage risks, a stop-loss can be placed at the breakeven level.

We revised the immediate support to MYR2,186, the low of 19 Mar. This is followed by MYR2,150. Moving up, the immediate resistance is now eyed at the MYR2,300 round figure, followed by MYR2,368, the high of 2 Apr.

Source: RHB Securities Research - 6 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024