FCPO - Profit Taking Sets In

rhboskres

Publish date: Tue, 07 Apr 2020, 09:17 AM

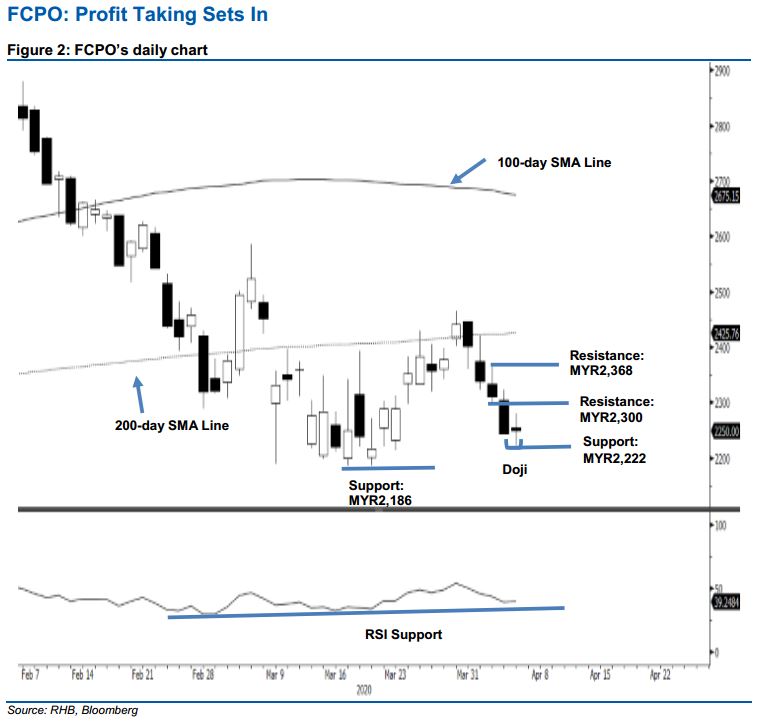

Maintain short positions as retracement leg stays firm. The FCPO managed to reverse from the earlier session’s weak tone – the low was recorded at MYR2,222 to settle MYR5 higher at MYR2,250. Consequently, a “Doji” candlestick formation has appeared. We view the latest performance as an indication of profit taking activity by the bears given the retracement over the previous three sessions. Without a clear price reversal signal, we believe the retracement, which resumed after the recent price rejection from the 200-day SMA line, is still firmly in place. Towards the upside, our negative trading bias would stay until the commodity manages to firmly cross above the MYR2,300 resistance level.

As we are not seeing the bulls regain control over the price trend, we keep to our recommendation for traders to stay in short positions. We initiated these at MYR2,339, the closing level of 1 Apr. To manage risks, a stop-loss can be placed at the breakeven level.

We revise the immediate support to MYR2,222, the latest low. This is followed by MYR2,186, the low of 19 Mar. Meanwhile, the immediate resistance set at the MYR2,300 round figure, followed by MYR2,368, the high of 2 Apr.

Source: RHB Securities Research - 7 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024