WTI Crude Futures - Bulls Are Pausing

rhboskres

Publish date: Tue, 07 Apr 2020, 09:38 AM

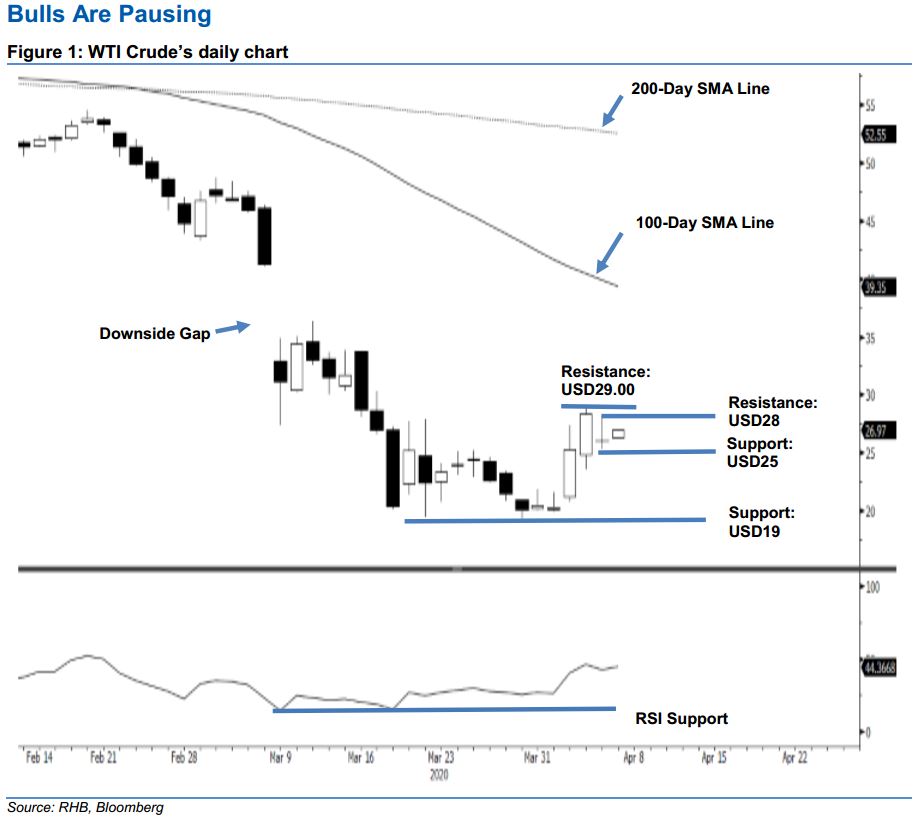

Minor pause set in; maintain long positions. The WTI Crude halted its two sessions of strong upward movement, as it ended USD2.26 lower at USD26.08. The closing level placed the commodity below the previous immediate support of USD27.00. The weak performance can be taken as a sign that the bulls are taking a pause to consolidate its recent sharp gains. However, as a trend, we believe the commodity’s rebound that started from an area near USD19.00 is still in place. The said rebound is taking place to correct the commodity’s previous multi-week sharp decline. The RSI reading, which is picking up but yet to reach an overbought threshold, is also supportive of our positive trading bias.

As the rebound has yet to signal exhaustion, we recommend traders to stay in long positions. These were initiated at USD25.32, the closing level of 2 Apr. To manage the risk, a stop-loss can be placed at the breakeven level.

The immediate support is revised to USD25.00, near the latest low. This is followed by USD23.50. Moving up, the resistance levels are expected at USD28.00, the price point of the latest session. This is followed by USD29.00.

Source: RHB Securities Research - 7 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024