COMEX Gold - Bulls Are Pushing on

rhboskres

Publish date: Tue, 07 Apr 2020, 09:39 AM

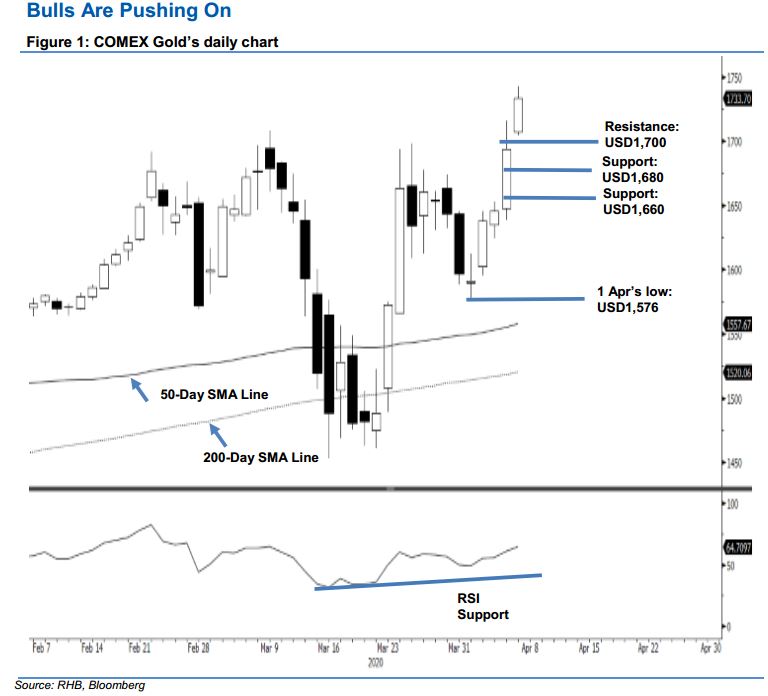

Maintain long positions as the uptrend continues to extend. The COMEX Gold displayed a continuation of its positive momentum, adding USD46.70 to settle at USD1,692.20. The high was posted at USD1,712.90. The strong performance reinforces our view that the commodity is on the path of extending its multi-month uptrend – this was after it recently completed its one-week correction phase which reached a low of USD1,576 on 1 Apr. The recent upward move is still healthy as it has yet to flash out an oversold RSI reading. This is further supported by both the 50-day and 200-day SMA lines which are still trending upward. Maintain our positive trading bias.

As the bulls are showing strength, we advise traders to stay in long positions. These were initiated at USD1,572.70, or the closing level of 23 Mar. To manage the risk, a stop-loss can now be placed below the USD1,640 level.

We revised the immediate support to USD1,680, derived from the latest session. This is followed by USD1,660, Towards the upside, the immediate resistance is now eyed at the USD1,700 round figure, followed by USD1,720.

Source: RHB Securities Research - 7 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024