E-mini Dow Futures - a Long White Candle Emerges

rhboskres

Publish date: Tue, 07 Apr 2020, 09:40 AM

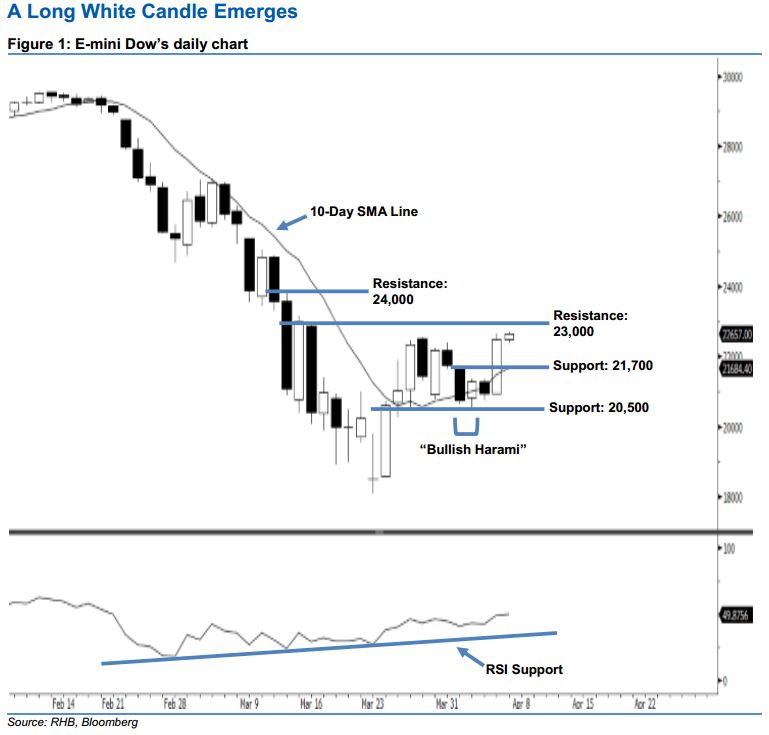

Stay long, with a trailing-stop below the 21,700-pt support. The E-mini Dow’s buying momentum continued as expected. A long white candle was formed last night, which pointed towards a continuation of the upside move. It surged 1,531 pts to close at 22,488 pts. Market sentiment remains positive, as the index has recovered above the 22,000-pt threshold and hit its 3-week high. We view yesterday’s white candle as a continuation of Apr’s “Bullish Harami” – a bullish reversal pattern. Overall, we remain positive on the E-mini Dow’s outlook.

Presently, we anticipate the immediate support level at 21,700 pts, which is situated near the midpoint of 6 Apr’s long white candle. The next support is seen at 20,500 pts, ie the low of 2 Apr’s “Bullish Harami” pattern. Towards the upside, the near-term resistance level is now set at the 23,000-pt psychological mark. This is followed by the 24,000-pt round figure.

To recap: On 26 Mar, we initially recommended traders initiate long positions above the 20,280-pt level. We continue to advise them to stay long for now while setting a trailing-stop below the 21,700-pt threshold. This is to lock in part of the profits.

Source: RHB Securities Research - 7 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024