FKLI - Rebound Continues To Extend

rhboskres

Publish date: Tue, 07 Apr 2020, 06:13 PM

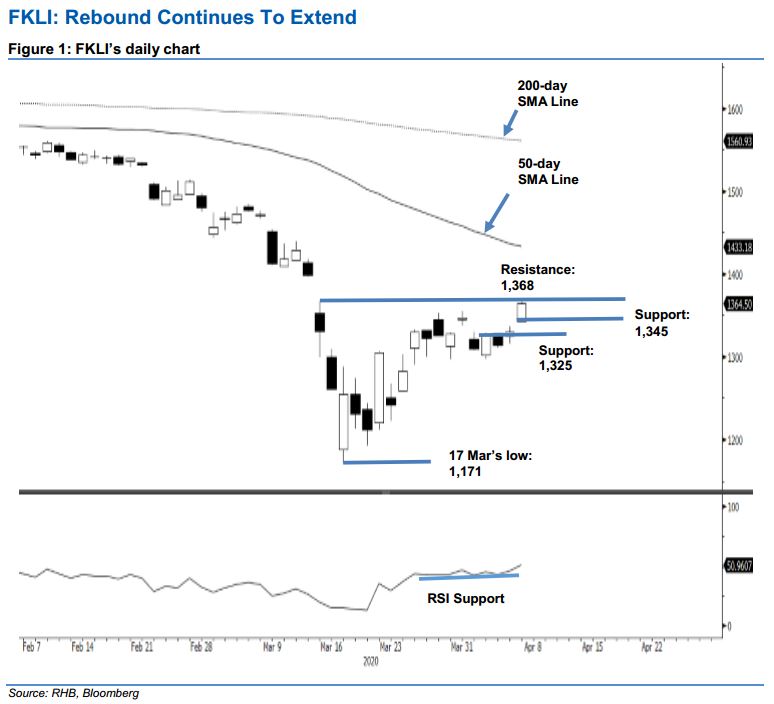

Maintain long positions as the index continues to perform well in the resistance zone. The FKLI continued to exhibit a strong price signal of its counter-trend rebound phase still developing. At the latest session, it settled 34 pts stronger at 1,364.5 pts, effectively trading near to the upper-bound of the resistance zone of 1,350-1,368 pts that we highlighted yesterday, without showing any sign of price rejection. The rebound resumed after the index completed its minor consolidation phase recently. The RSI reading is picking up but not showing an overbought reading – this suggests room for a further rebound. The ongoing rebound is meant to correct the index’s previous multi-month sharp retracement, which saw it breaching below the multi-year support level of 1,500 pts. Maintain positive trading bias.

We recommend traders to stay in long positions. We initiated these at 1,330.5 pts, the closing level of 6 Apr. To manage risks, a stop-loss can be placed at the breakeven mark.

The immediate support is revised to 1,345 pts, derived from the latest session. This is followed by 1,325 pts, price point of 6 Apr. Moving up, the resistance points are pegged at 1,368 pts – the high of 13 Mar, followed by 1,380 pts.

Source: RHB Securities Research - 7 Apr 2020