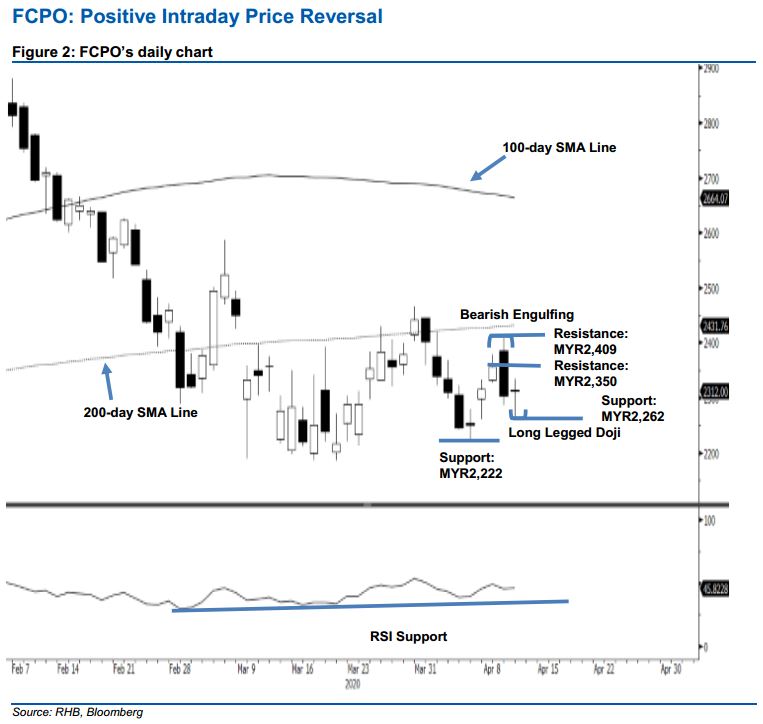

FCPO - Positive Intraday Price Reversal

rhboskres

Publish date: Mon, 13 Apr 2020, 09:57 AM

Rebound leg is still developing; maintain long positions. The FCPO staged a positive intraday price reversal to settle MYR8 higher at MYR2,312. The low of the day was at MYR2,262. Consequently, a “Long-Legged Doji” formation appeared. This is a positive price signal as it lent support to our assumption that the prior session’s “Bearish Harami” formation was just an indication of profit-taking activities. We believe the commodity is still trading in a sideways pattern, which has been in development since early March – this set in after the commodity underwent a sharp retracement between mid-January and early March. We maintain our positive trading bias.

As the bulls are still signalling control, traders should stay in long positions, which we initiated at MYR2,357, the closing level of 8 Apr. To manage risks, a stop-loss can be placed below MYR2,262

We revised the immediate support to MYR2,262 – the latest low. This is followed by MYR2,222, the low of 6 Apr. Moving up, the immediate resistance is eyed at MYR2,350, followed by MYR2,409 – both are derived from 9 Apr’s candle.

Source: RHB Securities Research - 13 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024