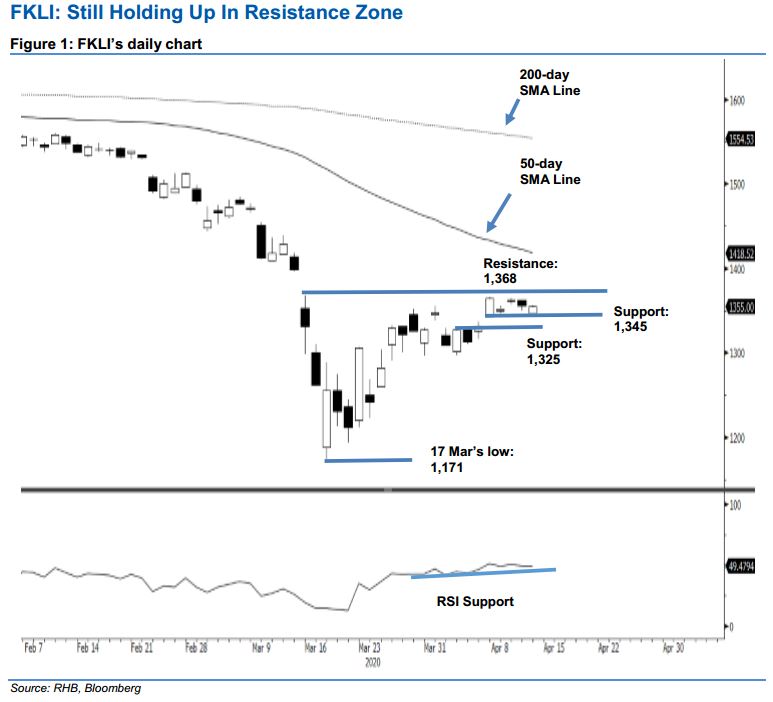

FKLI - Still Holding Up In Resistance Zone

rhboskres

Publish date: Tue, 14 Apr 2020, 10:12 AM

No price reversal signal; maintain long positions. The bulls continued to exert firm control over the FKLI's countertrend rebound. It reversed from an intraday low of 1,344.5 pts to close at 1,355 pts – indicating a 1-pt drop. The index’s price actions over the recent sessions indicate that it is likely undergoing a minor pause around the 1,350-1,368pt resistance zone. Without a clear price rejection from this zone, the rebound that started from the low of 1,171 pts on 17 Mar is still in place – and could extend further, once the ongoing pause is completed. Premised on this, we are maintaining our positive trading bias.

As the counter-trend rebound has yet to show a reversal signal, we recommend that traders remain in long positions. We initiated these at 1,330.5 pts, the closing level of 6 Apr. To manage risks, a stop-loss can be placed below 1,345 pts.

Immediate support is still at 1,345 pts, the price point of 7 Apr. This is followed by 1,325 pts, the price point of 6 Apr. Conversely, the resistance points are at 1,368 pts – the high of 13 Mar – followed by 1,380 pts.

Source: RHB Securities Research - 14 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024