Hang Seng Index Futures- Persistent Downwards Momentum

rhboskres

Publish date: Fri, 15 May 2020, 06:57 PM

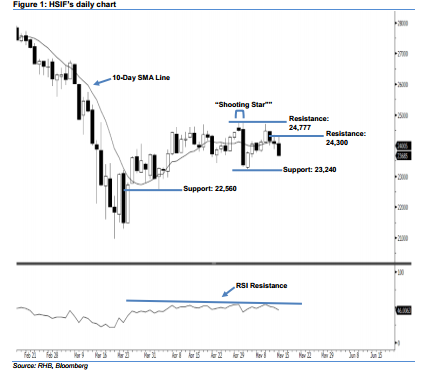

Downside move is likely to continue; stay short. The HSIF’s downside move continued as expected, as a third consecutive black candle was formed yesterday. This indicated a persistent selling momentum. The index declined 384 pts to settle at 23,685 pts. From a technical perspective, the selling momentum is likely to continue, after the HSIF marked a lower close vis-à-vis the previous sessions since 12 May. This may also further extend the downside swing, which started with 29 Apr’s “Shooting Star” pattern. Overall, we stay bearish on the index’s outlook.

Currently, we anticipate the immediate resistance level at 24,300 pts, which is situated near 14 May’s high. The crucial resistance is maintained at 24,777 pts, ie the high of 29 Apr’s “Shooting Star” pattern. To the downside, the immediate support level is seen at 23,240 pts, which is near the low of 5 May. If a breakdown arises, look to 22,560 pts – near the previous low of 2 Apr – as the next support.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 24,132-pt level on 8 May. A stop-loss can be set above the 24,777-pt mark to minimise the risk per trade.

Source: RHB Securities Research - 15 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024