COMEX Gold: Bulls Marginally Cross the Immediate Resistance

rhboskres

Publish date: Mon, 18 May 2020, 11:12 AM

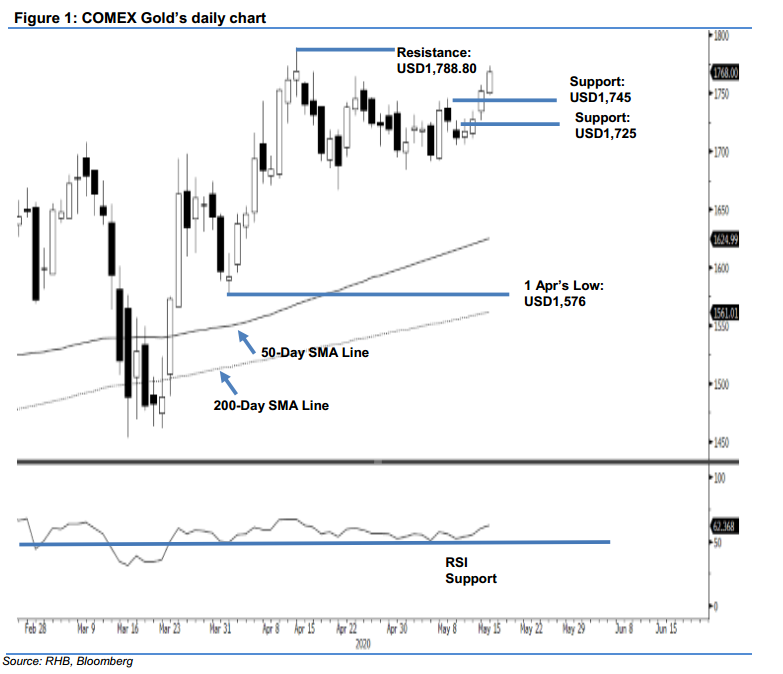

Maintain long positions on a possible uptrend extension. The COMEX Gold staged a positive follow-up following the prior session’s breakaway from the multi-week consolidation phase. At the close, the precious metal settled USD15.90 stronger at USD1,768 – slightly above the previous USD1,767 immediate resistance. Broadly, we believe the commodity is on the path of extending its uptrend after it completed the aforementioned multiweek consolidation phase. This positive bias is further supported by the 50-day and 200-day SMA lines, which both continue to trend upwards. We maintain our positive trading bias.

We advise traders to stay in long positions. We initiated these at USD1,752.10, or the closing level of 14 May. For risk-management purposes, a stop-loss can be placed below the USD1,705 mark.

We revise the immediate support to USD1,745, ie the price point of 14 May. This is followed by USD1,725, or the price point of 13 May. Moving up, the immediate resistance is now pegged to USD1,788.80 – the high of 14 Apr – and followed by the USD1,800 round figure.

Source: RHB Securities Research - 18 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024