Hang Seng Index Futures- the Downside Move Stays Intact

rhboskres

Publish date: Mon, 18 May 2020, 11:20 AM

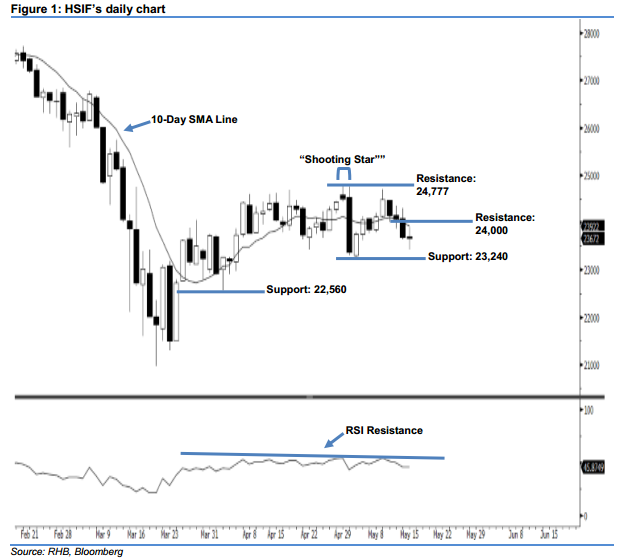

Stay short, with a trailing-stop set above the 24,000-pt level. The HSIF formed a “Doji” candle last Friday. It closed at 23,672 pts after hovering between a high of 23,911 pts and low of 23,421 pts. However, we maintain our negative sentiment, as the index is still trading below the 10-day SMA line. Last Friday’s “Doji” candle indicates that the sellers may be taking a pause following the recent losses. Overall, we think the downside swing, which began with 29 Apr’s “Shooting Star” pattern, should likely persist in the coming sessions.

As shown in the chart, the immediate resistance level is now anticipated at the 24,000-pt psychological mark. If a breakout arises, look to 24,777 pts – which was the high of 29 Apr’s “Shooting Star” pattern – as the next resistance. Towards the downside, we anticipate the immediate support level at 23,240 pts, ie near the low of 5 May. Meanwhile, the next support is seen at 22,560 pts, which was obtained near the low of 2 Apr.

Therefore, we advise traders to maintain short positions, given that we previously recommended initiating short below the 24,132-pt level on 8 May. For now, a trailing-stop can be set above the 24,000-pt threshold to limit the risk per trade.

Source: RHB Securities Research - 18 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024