WTI Crude Futures- Rebound Progressing Well

rhboskres

Publish date: Tue, 19 May 2020, 11:03 AM

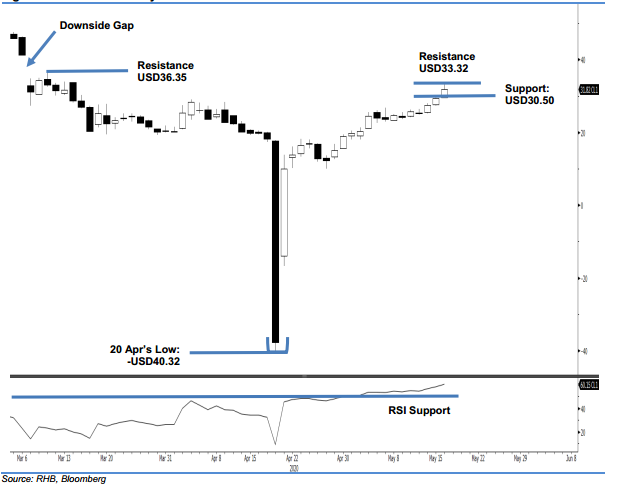

Bulls remain in control; maintain long positions. The WTI Crude’s rebound further extended into the latest session as it added USD2.39 to close at USD31.82. The closing level also placed the commodity above the previous resistance points of USD29.13 and USD31.00 – indicating the rebound’s momentum following 21 Apr’s “Bullish Harami” formation is still firmly in place. While the rebound over recent weeks has been relatively sharp, the RSI reading has yet to suggest it has reached an overbought threshold. In the absence of a price exhaustion signal, we are keeping our positive trading bias.

As the rebound is still showing signs of extending, we maintain our long positions recommendation while moving the trailing-stop loss to below USD27.00. These positions were initiated at USD15.06, or the closing level of 29 Apr.

We revise the immediate support to USD30.50 – the price point of the latest session. This is followed by USD29.13, which is the high of 3 Apr. Moving up, the immediate resistance is now eyed at USD33.32, the latest high. This is followed by USD36.35 – the high of 11 Mar.

Source: RHB Securities Research - 19 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024