FCPO- No Signs Of Exhaustion

rhboskres

Publish date: Wed, 20 May 2020, 11:24 AM

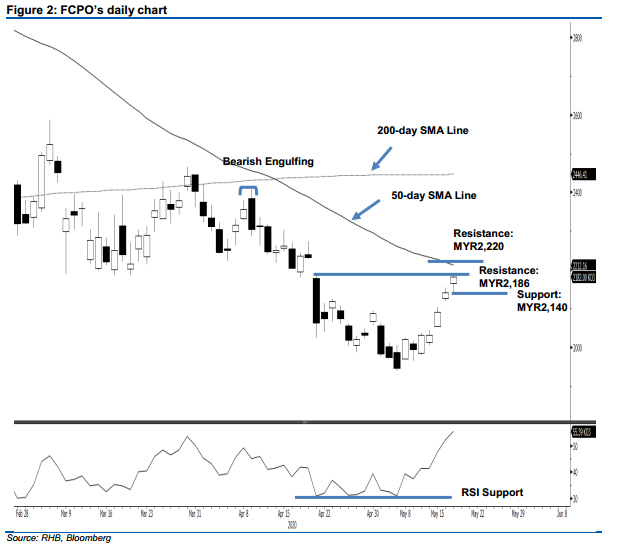

Bulls in firm control; maintain long positions. The FCPO continued to charge upward, ending MYR40.00 higher at MYR2,182 – after testing the immediate resistance of MYR2,186 with a high of MYR2,189. The commodity has been climbing healthily over the past week or so. This was after it underwent a multi-week retracement, following a downside breach from the 200-day SMA line in March. Towards the upside, we still expect the commodity to test the 50-day SMA line. The RSI reading, which continues to trend higher but has yet to reach the overbought threshold, also reinforces this view. Premised on this, we are maintaining our positive trading bias.

With no price exhaustion signal in sight, we advise traders to stay in long positions. The long call was initiated at MYR2,032, the closing level of 13 May. To manage risks, a stop-loss can be placed at the breakeven mark.

We revised the immediate support to MYR2,140, the latest low. This is followed by the MYR2,100 round figure. Conversely, the immediate resistance is at MYR2,186 – the high of 21 Apr. This is followed by MYR2,220, which is near the 50-day SMA line.

Source: RHB Securities Research - 27 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024