Hang Seng Index Futures: Long Positions Activated

rhboskres

Publish date: Wed, 20 May 2020, 11:29 AM

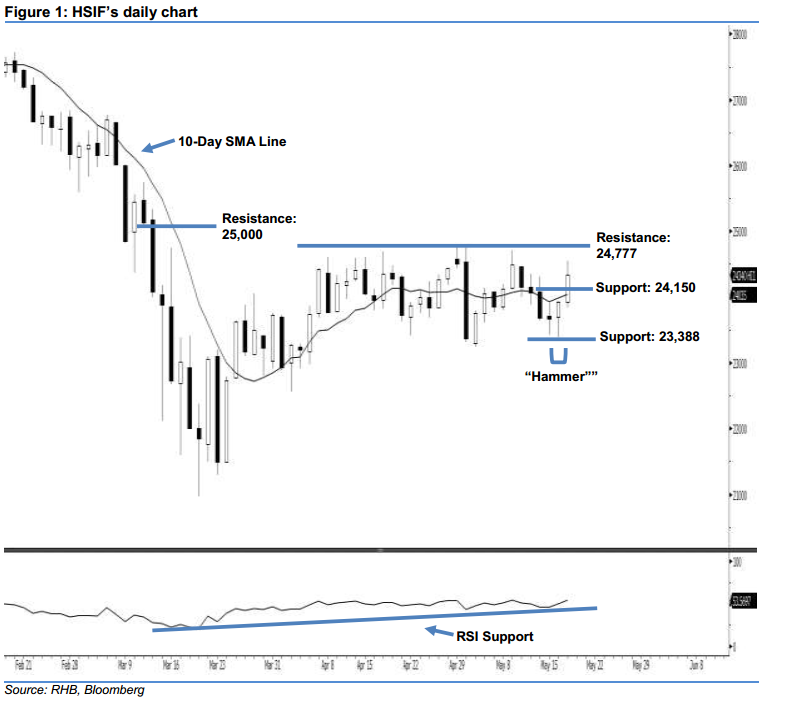

Initiate long positions above the 24,150-pt level. The HSIF formed a white candle yesterday. It rose 416 pts to close at 24,340 pts, off the session’s low of 23,843 pts. The index successfully closed above the 24,000-pt mark and posted a second consecutive white candle, implying that the sentiment has turned positive. This can be viewed as a continuation of the buyers extending the rebound from the “Hammer” that formed on 18 May. Yesterday’s closing has also triggered our stop-loss, which we had previously recommended at the 24,000-pt threshold.

According to the daily chart, the immediate support level is seen at 24,150 pts, set near the midpoint of 19 May’s white candle. The next support is anticipated at 23,388 pts, which was the low of 18 May’s “Hammer” pattern. To the upside, we anticipate the immediate resistance level at 24,777 pts, which was the high of 29 Apr’s “Shooting Star” pattern. Meanwhile, the next resistance would likely be at the 25,000-pt psychological mark.

Thus, we advise traders to initiate long positions above the 24,150-pt level. A stop-loss can be set below the 23,388- pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 20 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024