COMEX Gold- Intraday Reversal From the Immediate Support

rhboskres

Publish date: Wed, 20 May 2020, 11:37 AM

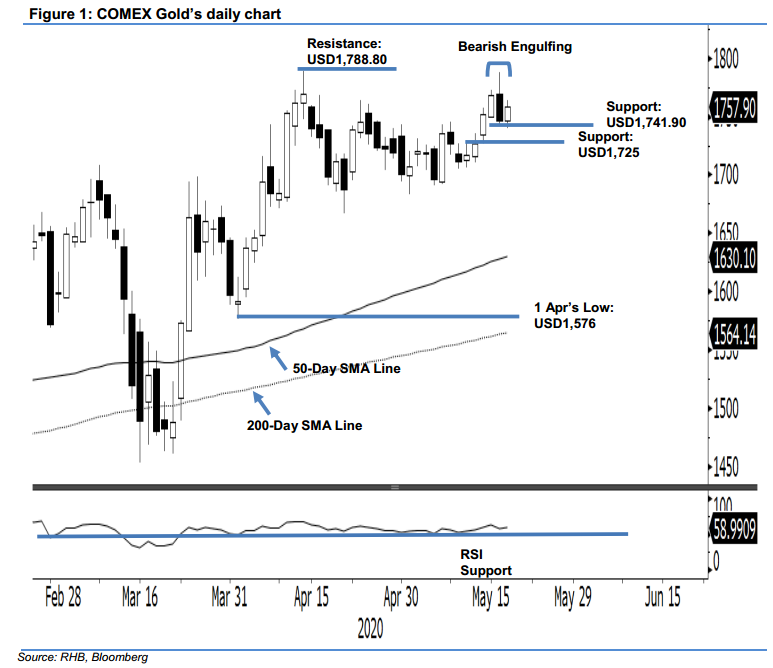

Maintain long positions, as the “Bearish Harami” formation remains unconfirmed. The COMEX Gold staged a positive intraday price reversal after testing the USD1,741.90 immediate support with a low of USD1,739.60 – this was before it closed at USD1,757.90. What this entails is that the prior session’s “Bearish Harami”, which appeared near the multi-year high of USD1,788.80, remains unconfirmed. On this, the commodity’s uptrend is still considered as intact. This is further supported by both the 50-day and 200-day SMA lines, which continue to trend higher, while the RSI reading is still holding above the neutral reading. We maintain our positive trading bias.

With no negative price follow-ups for said “Bearish Engulfing” formation, we advise traders to stay in long positions. We initiated these at USD1,752.10, or the closing level of 14 May. For risk-management purposes, a stop-loss can now be placed below the USD1,741.90 mark.

The immediate support is pegged at USD1,741.90, or the low of 18 May. This is followed by USD1,725, ie the price point of 13 May. Conversely, the immediate resistance is set at USD1,788.80 – the high of 14 Apr – and followed by the USD1,800 round figure.

Source: RHB Securities Research - 20 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024