WTI Crude Futures- Tightening Up the Trailing-Stop

rhboskres

Publish date: Thu, 21 May 2020, 11:47 AM

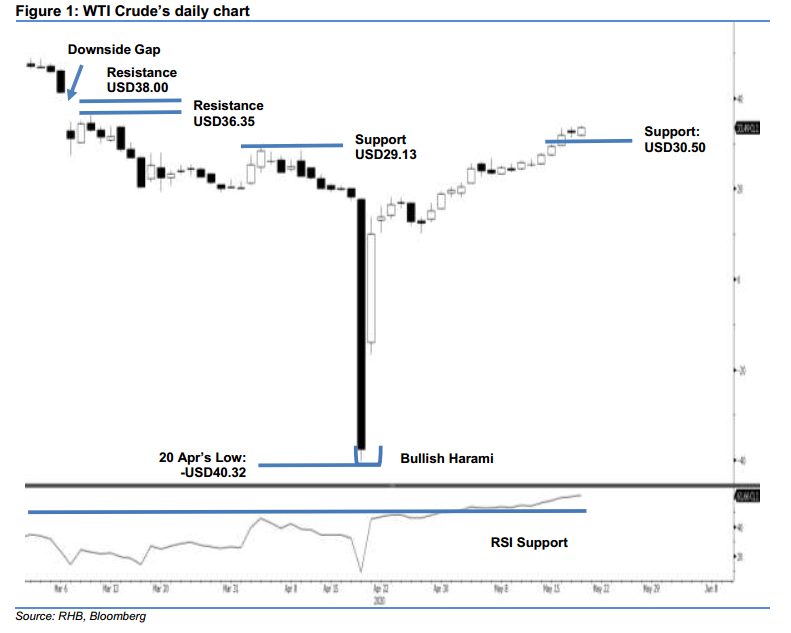

Maintain long positions. The WTI Crude ended the latest session on a firm footing, adding USD0.99 to close at USD33.49 – slightly above the previous USD33.32 resistance point. The black gold has been staging a relatively strong rebound following 21 Apr’s “Bullish Harami” formation, which appeared post the historic washout session on 20 Apr where prices reached negative territory. Price actions – following the recent breakout from the previous USD29.13 resistance – has been encouraging, as it signals a firm control by the bulls. The RSI is picking up, but has yet to reach the overbought reading. Hence, we maintain our positive trading bias.

On the observation that the bulls are still having a strong control over the rebound, we maintain our long position recommendations while moving the trailing-stop loss to below the USD30.50 threshold. These positions were initiated at USD15.06, or the closing level of 29 Apr.

We are keeping the immediate support at USD30.50 – the price point of 18 May. This is followed by USD29.13, which was the high of 3 Apr. Meanwhile, the immediate resistance is now pegged at USD36.35, or the high of 11 Mar, and followed by the USD38.00 level.

Source: RHB Securities Research - 21 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024