COMEX Gold- Back Into a Retracement Phase

rhboskres

Publish date: Thu, 28 May 2020, 04:51 PM

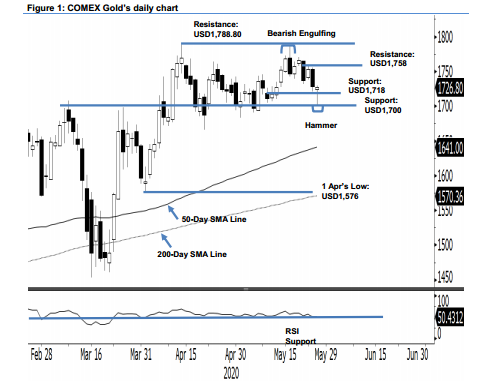

In retracement phase; short positions are active. The COMEX Gold managed to stage a positive intraday price reversal to significantly narrow its losses to USD1.14 and settle at USD1,726.80. This was after it hit a low of USD1,701.60 – near to testing the USD1,700 important resistance-turned-support level. Consequently, a “Hammer” candlestick formation appears. Despite the positive price reaction near the aforementioned support, it was still insufficient to signal that the correction phase – which started from 18 May’s “Bearish Engulfing” formation and appears near the USD1,788.80 resistance – has reached an end. Towards the upside, to confirm a possible completion of the correction phase, the commodity has to settle above the USD1,758 resistance mark. Until this happens, we are keeping our negative trading bias.

Our current short positions were triggered after the COMEX Gold crossed below the USD1,741.90 mark on 21 May. For risk-management purposes, a stop-loss can be placed above the USD1,758 level.

The immediate support is revised to USD1,718 – the price point of the latest session – and followed by USD1,700 Moving up, the immediate resistance is now pegged at USD1,758, ie the high of 22 May, and followed by USD1,788.80, or the high of 14 Apr.

Source: RHB Securities Research - 28 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024